Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) is expected to post its Q2 2026 results before the market opens on Thursday, October 30th. Analysts expect the company to announce earnings of $0.12 per share and revenue of $210.7450 million for the quarter. Allegro MicroSystems has set its Q2 2026 guidance at 0.100-0.140 EPS.Investors can check the company's upcoming Q2 2026 earningsummary page for the latest details on the call scheduled for Thursday, October 30, 2025 at 8:30 AM ET.

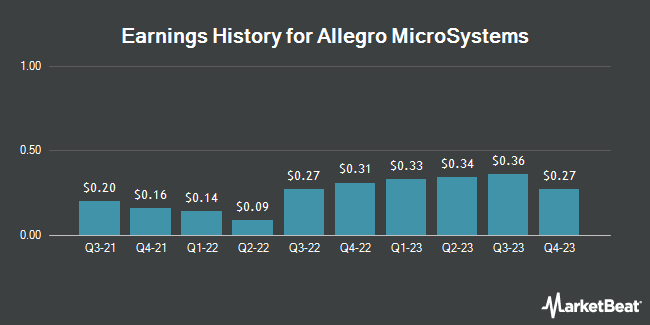

Allegro MicroSystems (NASDAQ:ALGM - Get Free Report) last issued its earnings results on Thursday, July 31st. The company reported $0.09 EPS for the quarter, hitting analysts' consensus estimates of $0.09. Allegro MicroSystems had a negative net margin of 9.00% and a positive return on equity of 2.09%. The business had revenue of $203.41 million for the quarter, compared to the consensus estimate of $197.82 million. During the same period in the prior year, the firm earned $0.03 EPS. The company's revenue for the quarter was up 21.9% compared to the same quarter last year. On average, analysts expect Allegro MicroSystems to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Allegro MicroSystems Stock Down 1.1%

Shares of NASDAQ:ALGM opened at $30.70 on Thursday. The business's 50 day moving average is $30.03 and its 200 day moving average is $28.68. The stock has a market cap of $5.68 billion, a P/E ratio of -82.97 and a beta of 1.72. Allegro MicroSystems has a 52-week low of $16.38 and a 52-week high of $38.45. The company has a quick ratio of 2.26, a current ratio of 3.70 and a debt-to-equity ratio of 0.34.

Insider Buying and Selling at Allegro MicroSystems

In other news, CAO Roald Graham Webster sold 8,266 shares of the stock in a transaction that occurred on Friday, August 22nd. The stock was sold at an average price of $32.81, for a total transaction of $271,207.46. Following the transaction, the chief accounting officer owned 17,300 shares in the company, valued at $567,613. This trade represents a 32.33% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 0.40% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several hedge funds have recently added to or reduced their stakes in ALGM. Canada Pension Plan Investment Board increased its position in Allegro MicroSystems by 154.2% during the second quarter. Canada Pension Plan Investment Board now owns 6,100 shares of the company's stock worth $209,000 after purchasing an additional 3,700 shares during the last quarter. AQR Capital Management LLC purchased a new position in shares of Allegro MicroSystems in the 1st quarter valued at about $325,000. Amundi purchased a new position in shares of Allegro MicroSystems in the 2nd quarter valued at $358,000. Vident Advisory LLC boosted its position in shares of Allegro MicroSystems by 17.3% in the 2nd quarter. Vident Advisory LLC now owns 11,823 shares of the company's stock valued at $404,000 after purchasing an additional 1,742 shares during the period. Finally, Federated Hermes Inc. increased its stake in Allegro MicroSystems by 62.9% in the second quarter. Federated Hermes Inc. now owns 12,204 shares of the company's stock valued at $417,000 after purchasing an additional 4,712 shares during the period. 56.45% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of brokerages recently weighed in on ALGM. Zacks Research raised Allegro MicroSystems to a "hold" rating in a research report on Monday, August 11th. TD Cowen lowered their price target on shares of Allegro MicroSystems from $42.00 to $37.00 and set a "buy" rating on the stock in a report on Friday, August 1st. Mizuho lifted their price objective on shares of Allegro MicroSystems from $37.00 to $40.00 and gave the stock an "outperform" rating in a research report on Friday, August 1st. Wells Fargo & Company reissued an "overweight" rating and set a $42.00 target price (up previously from $33.00) on shares of Allegro MicroSystems in a research report on Wednesday, July 16th. Finally, Morgan Stanley lowered their target price on shares of Allegro MicroSystems from $38.00 to $35.00 and set an "equal weight" rating for the company in a research note on Friday, August 1st. Eight analysts have rated the stock with a Buy rating, two have assigned a Hold rating and one has given a Sell rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $36.78.

View Our Latest Stock Report on ALGM

Allegro MicroSystems Company Profile

(

Get Free Report)

Allegro MicroSystems, Inc, together with its subsidiaries, designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems. Its products include magnetic sensor ICs, such as position, speed, and current sensor ICs; and power ICs comprising motor driver ICs, regulator and LED driver ICs, and isolated gate drivers.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Allegro MicroSystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegro MicroSystems wasn't on the list.

While Allegro MicroSystems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.