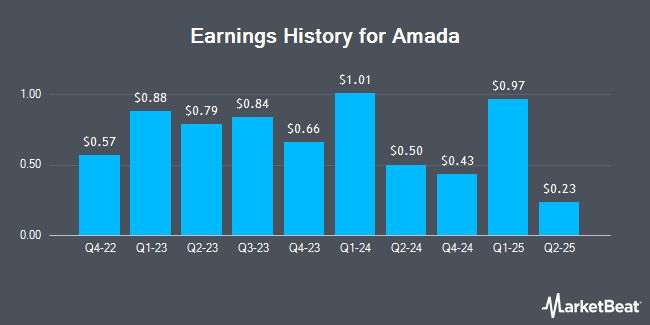

Amada (OTCMKTS:AMDLY - Get Free Report) issued its quarterly earnings data on Thursday. The company reported $0.23 EPS for the quarter, missing the consensus estimate of $0.49 by ($0.26), Zacks reports. The company had revenue of $524.26 million during the quarter, compared to the consensus estimate of $585.20 million. Amada had a net margin of 7.29% and a return on equity of 5.45%.

Amada Stock Performance

Shares of AMDLY remained flat at $46.00 during trading hours on Wednesday. Amada has a twelve month low of $33.53 and a twelve month high of $49.32. The stock has a market capitalization of $3.77 billion, a price-to-earnings ratio of 19.74 and a beta of 0.24. The firm's 50-day simple moving average is $43.09 and its 200-day simple moving average is $40.25.

Amada Company Profile

(

Get Free Report)

Amada Co, Ltd., together with its subsidiaries, manufactures, sells, leases, repairs, maintains, checks, and inspects metalworking machinery, software, and peripheral equipment in Japan, North America, Europe, Asia, and internationally. It offers sheet metal fabrication machines, including laser machines, punch and laser combination machines, turret punch presses, press brakes, bending robots, and welders, as well as software solutions; general fabrication machines, such as shearing and deburring machines, corner shear, iron worker, AMS SPACE series, horizontal benders, tapping and fastener insertion machines, and environment related products; cutting fluids, lubricants, and other consumables; and a range of tools for bending and punching.

See Also

Before you consider Amada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amada wasn't on the list.

While Amada currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.