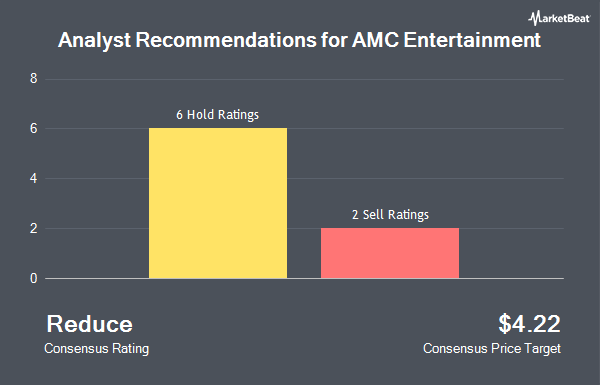

Shares of AMC Entertainment Holdings, Inc. (NYSE:AMC - Get Free Report) have received a consensus rating of "Reduce" from the eight analysts that are covering the company, Marketbeat reports. Two analysts have rated the stock with a sell recommendation and six have issued a hold recommendation on the company. The average 1-year target price among brokers that have issued ratings on the stock in the last year is $4.65.

Several research firms have issued reports on AMC. Macquarie reissued a "neutral" rating and issued a $4.00 price objective on shares of AMC Entertainment in a research report on Wednesday, February 26th. Roth Mkm lowered their price target on AMC Entertainment from $3.25 to $3.00 and set a "neutral" rating for the company in a report on Wednesday, April 16th. Roth Capital set a $3.25 price target on shares of AMC Entertainment in a report on Tuesday, February 4th. StockNews.com raised AMC Entertainment to a "sell" rating in a research report on Saturday, February 22nd. Finally, Benchmark reissued a "hold" rating on shares of AMC Entertainment in a research report on Monday, March 3rd.

Check Out Our Latest Stock Report on AMC

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of the company. Vanguard Group Inc. increased its stake in shares of AMC Entertainment by 4.4% during the fourth quarter. Vanguard Group Inc. now owns 36,854,559 shares of the company's stock worth $146,681,000 after purchasing an additional 1,558,554 shares in the last quarter. Marshall Wace LLP boosted its stake in shares of AMC Entertainment by 85.4% in the fourth quarter. Marshall Wace LLP now owns 2,801,788 shares of the company's stock worth $11,151,000 after acquiring an additional 1,290,376 shares during the last quarter. JPMorgan Chase & Co. increased its position in shares of AMC Entertainment by 91.5% during the fourth quarter. JPMorgan Chase & Co. now owns 2,263,513 shares of the company's stock worth $9,009,000 after purchasing an additional 1,081,464 shares in the last quarter. Balyasny Asset Management L.P. purchased a new position in AMC Entertainment in the 4th quarter valued at $3,646,000. Finally, KBC Group NV boosted its stake in AMC Entertainment by 7,771.5% during the 4th quarter. KBC Group NV now owns 648,141 shares of the company's stock worth $2,580,000 after purchasing an additional 639,907 shares during the last quarter. Institutional investors and hedge funds own 28.80% of the company's stock.

AMC Entertainment Stock Down 0.4 %

NYSE:AMC traded down $0.01 during mid-day trading on Friday, hitting $2.67. 9,597,821 shares of the stock traded hands, compared to its average volume of 22,985,832. AMC Entertainment has a 52 week low of $2.45 and a 52 week high of $11.88. The stock has a market capitalization of $1.15 billion, a price-to-earnings ratio of -1.66 and a beta of 1.64. The firm's 50 day moving average is $2.93 and its two-hundred day moving average is $3.67.

About AMC Entertainment

(

Get Free ReportAMC Entertainment Holdings, Inc, through its subsidiaries, engages in the theatrical exhibition business. It owns, operates, or has interests in theatres in the United States and Europe. The company was founded in 1920 and is headquartered in Leawood, Kansas.

Featured Stories

Before you consider AMC Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMC Entertainment wasn't on the list.

While AMC Entertainment currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.