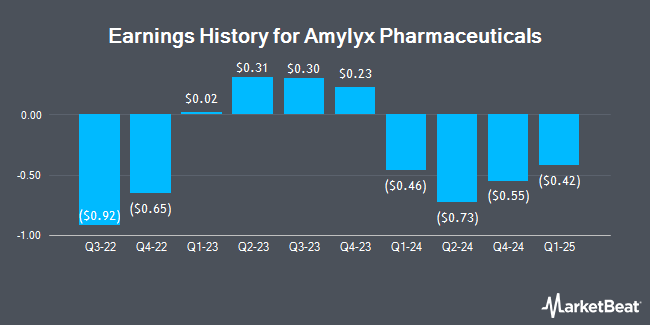

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) will likely be announcing its Q2 2025 earnings results before the market opens on Thursday, August 7th. Analysts expect the company to announce earnings of ($0.43) per share for the quarter.

Amylyx Pharmaceuticals (NASDAQ:AMLX - Get Free Report) last announced its earnings results on Thursday, May 8th. The company reported ($0.42) EPS for the quarter, topping the consensus estimate of ($0.45) by $0.03. On average, analysts expect Amylyx Pharmaceuticals to post $-2 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Amylyx Pharmaceuticals Stock Performance

Shares of AMLX stock traded up $0.23 during midday trading on Tuesday, hitting $8.19. 639,392 shares of the company were exchanged, compared to its average volume of 1,112,792. The firm has a market capitalization of $729.62 million, a P/E ratio of -2.63 and a beta of -0.46. The firm's 50 day moving average price is $6.55 and its two-hundred day moving average price is $4.86. Amylyx Pharmaceuticals has a 52 week low of $1.76 and a 52 week high of $8.72.

Hedge Funds Weigh In On Amylyx Pharmaceuticals

A hedge fund recently raised its stake in Amylyx Pharmaceuticals stock. Goldman Sachs Group Inc. raised its holdings in Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX - Free Report) by 7.7% in the 1st quarter, according to the company in its most recent filing with the SEC. The firm owned 2,002,961 shares of the company's stock after acquiring an additional 143,065 shares during the quarter. Goldman Sachs Group Inc. owned approximately 2.25% of Amylyx Pharmaceuticals worth $7,090,000 as of its most recent SEC filing. Hedge funds and other institutional investors own 95.84% of the company's stock.

Analyst Ratings Changes

A number of research firms have issued reports on AMLX. Leerink Partners raised shares of Amylyx Pharmaceuticals from a "market perform" rating to an "outperform" rating and boosted their price objective for the company from $4.00 to $10.00 in a report on Wednesday, May 7th. TD Cowen assumed coverage on shares of Amylyx Pharmaceuticals in a report on Friday, May 30th. They issued a "buy" rating for the company. Citigroup assumed coverage on shares of Amylyx Pharmaceuticals in a research report on Tuesday, June 17th. They issued a "buy" rating and a $12.00 target price for the company. UBS Group upgraded shares of Amylyx Pharmaceuticals to a "hold" rating in a research report on Tuesday, June 24th. Finally, Jefferies Financial Group assumed coverage on shares of Amylyx Pharmaceuticals in a research report on Tuesday, June 24th. They issued a "hold" rating for the company. Three equities research analysts have rated the stock with a hold rating, nine have assigned a buy rating and two have assigned a strong buy rating to the company. According to data from MarketBeat, Amylyx Pharmaceuticals currently has an average rating of "Moderate Buy" and an average price target of $11.75.

Check Out Our Latest Report on Amylyx Pharmaceuticals

About Amylyx Pharmaceuticals

(

Get Free Report)

Amylyx Pharmaceuticals, Inc, a commercial-stage biotechnology company, engages in the discovery and development of treatment for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases. The company's products include RELYVRIO, a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate and taurursodiol for the treatment of ALS in adults in the United States and marketed as ALBRIOZA for the treatment of ALS in Canada.

Further Reading

Before you consider Amylyx Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amylyx Pharmaceuticals wasn't on the list.

While Amylyx Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.