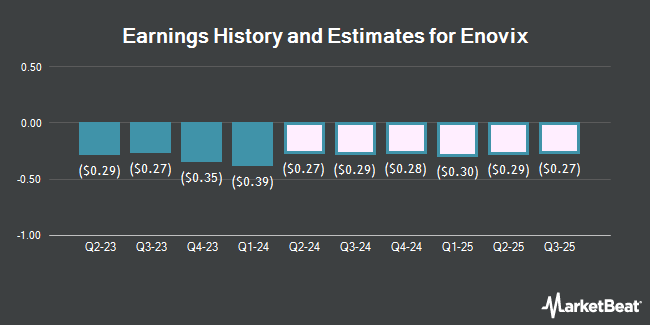

Enovix Co. (NASDAQ:ENVX - Free Report) - Equities researchers at Cantor Fitzgerald issued their FY2026 earnings estimates for Enovix in a research report issued on Monday, June 9th. Cantor Fitzgerald analyst D. Soderberg expects that the company will earn ($0.97) per share for the year. Cantor Fitzgerald has a "Overweight" rating and a $30.00 price target on the stock. The consensus estimate for Enovix's current full-year earnings is ($1.01) per share.

A number of other brokerages have also recently weighed in on ENVX. Craig Hallum reduced their target price on Enovix from $20.00 to $18.00 and set a "buy" rating on the stock in a report on Thursday, February 20th. B. Riley lowered their target price on Enovix from $17.00 to $12.00 and set a "buy" rating for the company in a research note on Tuesday, April 29th. JPMorgan Chase & Co. dropped their price target on shares of Enovix from $10.00 to $9.00 and set an "overweight" rating on the stock in a research note on Thursday, May 1st. TD Securities cut their target price on Enovix from $10.00 to $7.00 and set a "hold" rating on the stock in a research report on Thursday, May 1st. Finally, Benchmark cut their target price on shares of Enovix from $25.00 to $15.00 and set a "buy" rating on the stock in a research note on Tuesday, April 15th. Three investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $17.27.

Get Our Latest Research Report on Enovix

Enovix Trading Down 5.0%

Shares of NASDAQ ENVX traded down $0.43 during trading on Tuesday, hitting $8.22. 4,012,937 shares of the company traded hands, compared to its average volume of 5,905,042. The firm has a market capitalization of $1.58 billion, a P/E ratio of -5.67 and a beta of 2.00. The company has a quick ratio of 3.61, a current ratio of 3.77 and a debt-to-equity ratio of 0.99. The company has a 50-day moving average price of $7.17 and a 200-day moving average price of $8.93. Enovix has a 1 year low of $5.27 and a 1 year high of $18.68.

Institutional Inflows and Outflows

A number of institutional investors have recently added to or reduced their stakes in the stock. Deutsche Bank AG lifted its stake in Enovix by 44.8% in the fourth quarter. Deutsche Bank AG now owns 140,606 shares of the company's stock valued at $1,528,000 after buying an additional 43,498 shares during the last quarter. Vanguard Group Inc. increased its holdings in shares of Enovix by 15.1% in the 4th quarter. Vanguard Group Inc. now owns 15,773,464 shares of the company's stock worth $171,458,000 after acquiring an additional 2,063,631 shares during the period. Strong Tower Advisory Services increased its holdings in shares of Enovix by 93.1% in the 1st quarter. Strong Tower Advisory Services now owns 144,045 shares of the company's stock worth $1,057,000 after acquiring an additional 69,435 shares during the period. Haven Private LLC bought a new stake in Enovix in the 4th quarter valued at about $454,000. Finally, Amundi boosted its stake in Enovix by 360.8% during the 4th quarter. Amundi now owns 235,369 shares of the company's stock valued at $2,558,000 after purchasing an additional 184,294 shares during the period. 50.92% of the stock is currently owned by institutional investors.

Enovix Company Profile

(

Get Free Report)

Enovix Corporation designs develops and manufactures silicon-anode lithium-ion batteries. It serves wearables and IoT, smartphone, laptops and tablets, industrial and medical, and electric vehicles industries. The company was founded in 2007 and is headquartered in Fremont, California.

Recommended Stories

Before you consider Enovix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovix wasn't on the list.

While Enovix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.