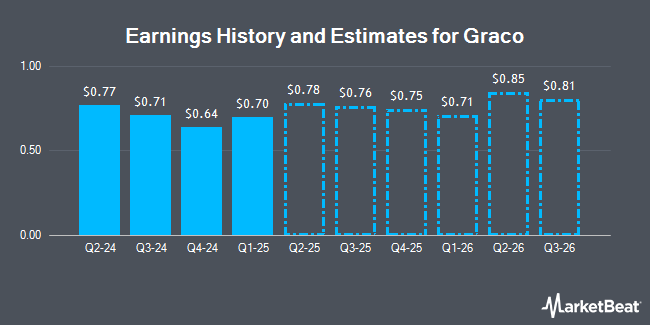

Graco Inc. (NYSE:GGG - Free Report) - William Blair lifted their Q3 2025 EPS estimates for Graco in a research note issued to investors on Thursday, July 24th. William Blair analyst R. Sparenblek now forecasts that the industrial products company will post earnings per share of $0.78 for the quarter, up from their prior forecast of $0.76. The consensus estimate for Graco's current full-year earnings is $3.06 per share. William Blair also issued estimates for Graco's Q4 2025 earnings at $0.75 EPS.

GGG has been the topic of a number of other reports. Robert W. Baird boosted their price target on shares of Graco from $88.00 to $91.00 and gave the stock a "neutral" rating in a research note on Friday. Wolfe Research started coverage on shares of Graco in a research note on Wednesday, June 18th. They set an "outperform" rating on the stock. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $94.50.

Read Our Latest Analysis on GGG

Graco Price Performance

Shares of NYSE:GGG opened at $84.54 on Monday. The firm has a market capitalization of $14.01 billion, a PE ratio of 29.98, a price-to-earnings-growth ratio of 2.86 and a beta of 1.06. The firm's 50-day moving average is $85.79 and its two-hundred day moving average is $84.14. Graco has a 1 year low of $72.06 and a 1 year high of $92.86.

Graco (NYSE:GGG - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The industrial products company reported $0.75 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.78 by ($0.03). The business had revenue of $571.81 million for the quarter, compared to analysts' expectations of $590.57 million. Graco had a return on equity of 19.05% and a net margin of 22.26%. The firm's revenue for the quarter was up 3.4% on a year-over-year basis. During the same quarter last year, the company earned $0.77 earnings per share.

Graco Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, August 6th. Investors of record on Monday, July 21st will be paid a dividend of $0.275 per share. The ex-dividend date is Monday, July 21st. This represents a $1.10 dividend on an annualized basis and a dividend yield of 1.30%. Graco's payout ratio is 39.01%.

Insider Buying and Selling at Graco

In related news, insider David J. Thompson sold 3,588 shares of the company's stock in a transaction that occurred on Tuesday, May 13th. The shares were sold at an average price of $86.23, for a total transaction of $309,393.24. Following the sale, the insider directly owned 27,520 shares in the company, valued at approximately $2,373,049.60. This represents a 11.53% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 2.19% of the company's stock.

Institutional Trading of Graco

Large investors have recently made changes to their positions in the company. eCIO Inc. purchased a new stake in shares of Graco during the first quarter worth approximately $32,000. Thurston Springer Miller Herd & Titak Inc. increased its stake in shares of Graco by 41.5% during the second quarter. Thurston Springer Miller Herd & Titak Inc. now owns 481 shares of the industrial products company's stock worth $41,000 after buying an additional 141 shares during the period. WPG Advisers LLC purchased a new stake in shares of Graco during the first quarter worth approximately $41,000. Geneos Wealth Management Inc. increased its stake in shares of Graco by 982.6% during the first quarter. Geneos Wealth Management Inc. now owns 498 shares of the industrial products company's stock worth $42,000 after buying an additional 452 shares during the period. Finally, Wood Tarver Financial Group LLC purchased a new stake in shares of Graco during the fourth quarter worth approximately $46,000. 93.88% of the stock is currently owned by hedge funds and other institutional investors.

About Graco

(

Get Free Report)

Graco Inc designs, manufactures, and markets systems and equipment used to move, measure, control, dispense, and spray fluid and powder materials worldwide. The Contractor segment offers sprayers to apply paint to walls and other structures; two-component proportioning systems that are used to spray polyurethane foam and polyurea coatings; and viscous coatings to roofs, as well as markings on roads, parking lots, athletic fields, and floors.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Graco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graco wasn't on the list.

While Graco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.