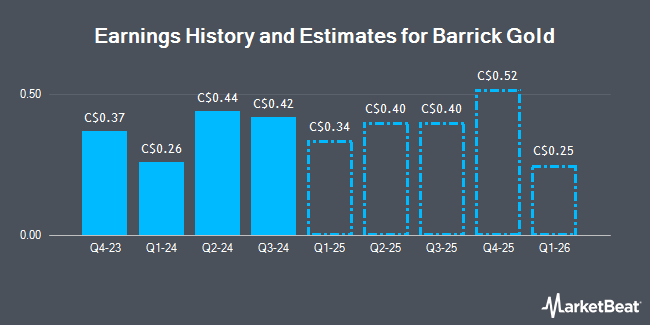

Barrick Gold Co. (TSE:ABX - Free Report) NYSE: ABX - Stock analysts at Raymond James Financial cut their Q3 2025 EPS estimates for Barrick Gold in a report released on Monday, August 11th. Raymond James Financial analyst B. Macarthur now forecasts that the basic materials company will post earnings per share of $0.74 for the quarter, down from their previous estimate of $0.76. The consensus estimate for Barrick Gold's current full-year earnings is $2.24 per share. Raymond James Financial also issued estimates for Barrick Gold's FY2025 earnings at $2.63 EPS.

A number of other brokerages have also recently commented on ABX. Sanford C. Bernstein dropped their price objective on shares of Barrick Gold from C$45.00 to C$43.00 and set an "outperform" rating for the company in a research note on Friday, May 2nd. Cibc World Mkts upgraded shares of Barrick Gold from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 12th. Finally, Stifel Nicolaus upped their price target on shares of Barrick Gold from C$34.00 to C$37.00 and gave the company a "buy" rating in a research note on Monday, April 21st. Four analysts have rated the stock with a Strong Buy rating, five have given a Buy rating and four have given a Hold rating to the company's stock. Based on data from MarketBeat.com, Barrick Gold presently has an average rating of "Buy" and a consensus target price of C$33.14.

View Our Latest Report on ABX

Barrick Gold Price Performance

TSE ABX traded down C$0.04 on Thursday, reaching C$33.46. The company had a trading volume of 1,194,046 shares, compared to its average volume of 3,709,755. The company has a quick ratio of 2.62, a current ratio of 2.65 and a debt-to-equity ratio of 19.83. The stock has a market capitalization of C$40.67 billion, a PE ratio of 25.19, a price-to-earnings-growth ratio of 2.34 and a beta of 0.48. The firm's 50 day moving average price is C$29.58 and its 200 day moving average price is C$27.54. Barrick Gold has a 12 month low of C$21.73 and a 12 month high of C$33.88.

Barrick Gold Company Profile

(

Get Free Report)

Barrick Gold Corp is one of the world's largest gold producers, operating mines in North America, South America, Australia, and Africa. The company segments consist of nine gold mines namely Carlin, Cortez, Turquoise Ridge, Pueblo Viejo, Loulo-Gounkoto, Kibali, Veladero, North Mara, and Bulyanhulu. It generates maximum revenue from the Carlin mine segment.

Read More

Before you consider Barrick Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Gold wasn't on the list.

While Barrick Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.