Lands' End, Inc. (NASDAQ:LE - Free Report) - Analysts at Telsey Advisory Group raised their Q3 2026 EPS estimates for shares of Lands' End in a research note issued to investors on Wednesday, September 10th. Telsey Advisory Group analyst D. Telsey now expects that the company will earn $0.16 per share for the quarter, up from their previous forecast of $0.10. The consensus estimate for Lands' End's current full-year earnings is $0.41 per share. Telsey Advisory Group also issued estimates for Lands' End's Q4 2026 earnings at $0.79 EPS, FY2026 earnings at $0.71 EPS and FY2027 earnings at $0.91 EPS.

Separately, Wall Street Zen raised shares of Lands' End from a "hold" rating to a "buy" rating in a research note on Saturday.

Check Out Our Latest Report on Lands' End

Lands' End Price Performance

NASDAQ:LE traded up $0.19 on Thursday, hitting $15.66. The company had a trading volume of 90,073 shares, compared to its average volume of 283,574. The stock has a market capitalization of $477.91 million, a price-to-earnings ratio of 87.00 and a beta of 2.34. The company has a current ratio of 1.62, a quick ratio of 0.41 and a debt-to-equity ratio of 1.13. The firm has a 50 day moving average of $13.09 and a two-hundred day moving average of $10.82. Lands' End has a 52 week low of $7.65 and a 52 week high of $19.88.

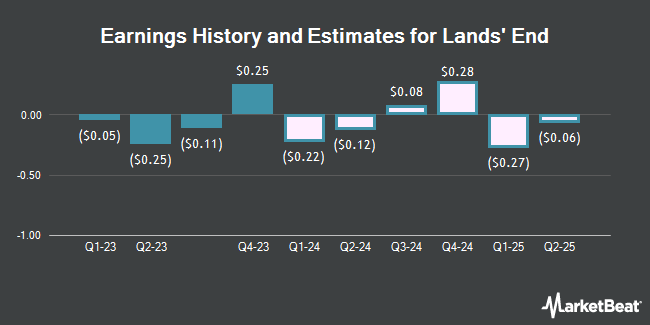

Lands' End (NASDAQ:LE - Get Free Report) last issued its quarterly earnings data on Tuesday, September 9th. The company reported ($0.06) EPS for the quarter, missing the consensus estimate of ($0.03) by ($0.03). The company had revenue of $294.08 million during the quarter, compared to the consensus estimate of $323.96 million. Lands' End had a net margin of 0.46% and a return on equity of 5.32%. During the same period in the previous year, the company earned ($0.02) EPS. Lands' End has set its Q3 2025 guidance at 0.100-0.220 EPS. FY 2025 guidance at 0.620-0.88 EPS.

Hedge Funds Weigh In On Lands' End

Several institutional investors and hedge funds have recently added to or reduced their stakes in LE. Northern Trust Corp increased its position in Lands' End by 7.3% in the 4th quarter. Northern Trust Corp now owns 169,703 shares of the company's stock valued at $2,230,000 after acquiring an additional 11,506 shares during the period. Jane Street Group LLC increased its position in shares of Lands' End by 17.4% during the fourth quarter. Jane Street Group LLC now owns 17,998 shares of the company's stock worth $236,000 after buying an additional 2,666 shares during the period. Bank of America Corp DE increased its position in shares of Lands' End by 320.8% during the fourth quarter. Bank of America Corp DE now owns 51,811 shares of the company's stock worth $681,000 after buying an additional 39,499 shares during the period. Balyasny Asset Management L.P. acquired a new stake in shares of Lands' End during the fourth quarter worth $172,000. Finally, Millennium Management LLC increased its position in shares of Lands' End by 10.1% during the fourth quarter. Millennium Management LLC now owns 67,658 shares of the company's stock worth $889,000 after buying an additional 6,192 shares during the period. 37.46% of the stock is currently owned by institutional investors and hedge funds.

About Lands' End

(

Get Free Report)

Lands' End, Inc operates as a digital retailer of apparel, swimwear, outerwear, accessories, footwear, home products, and uniform in the United States, Europe, Asia, and internationally. It operates through U.S. eCommerce, International, Outfitters, Third Party, and Retail segments. The company also sells uniform and logo apparel.

Featured Stories

Before you consider Lands' End, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lands' End wasn't on the list.

While Lands' End currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.