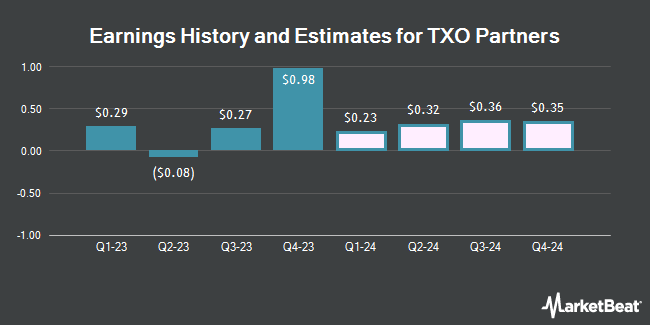

TXO Partners LP (NYSE:TXO - Free Report) - Equities research analysts at Capital One Financial boosted their Q3 2025 earnings per share (EPS) estimates for TXO Partners in a report released on Wednesday, August 27th. Capital One Financial analyst P. Johnston now expects that the company will post earnings per share of $0.09 for the quarter, up from their previous forecast of $0.07. The consensus estimate for TXO Partners' current full-year earnings is $1.02 per share. Capital One Financial also issued estimates for TXO Partners' Q4 2025 earnings at $0.07 EPS, FY2025 earnings at $0.23 EPS, Q1 2026 earnings at $0.05 EPS, Q2 2026 earnings at $0.09 EPS, Q3 2026 earnings at $0.09 EPS, Q4 2026 earnings at $0.10 EPS and FY2027 earnings at $0.39 EPS.

Several other equities analysts have also recently weighed in on TXO. Wall Street Zen upgraded TXO Partners from a "sell" rating to a "hold" rating in a report on Saturday, August 9th. Raymond James Financial reiterated a "strong-buy" rating and set a $24.00 price objective (up previously from $23.00) on shares of TXO Partners in a report on Friday, July 25th. Finally, Stifel Nicolaus lifted their price objective on TXO Partners from $20.00 to $21.00 and gave the company a "buy" rating in a report on Thursday, August 14th. One investment analyst has rated the stock with a Strong Buy rating and one has issued a Buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Strong Buy" and a consensus price target of $22.50.

View Our Latest Research Report on TXO Partners

TXO Partners Trading Down 2.1%

TXO traded down $0.29 during midday trading on Monday, reaching $13.53. 155,169 shares of the company were exchanged, compared to its average volume of 200,941. The company has a debt-to-equity ratio of 0.03, a quick ratio of 0.97 and a current ratio of 0.97. TXO Partners has a one year low of $13.35 and a one year high of $20.70. The stock has a market capitalization of $741.17 million, a P/E ratio of 41.00 and a beta of 0.09. The stock's 50-day simple moving average is $14.66 and its 200 day simple moving average is $16.31.

Institutional Inflows and Outflows

Several institutional investors have recently made changes to their positions in the stock. State of Wyoming bought a new position in shares of TXO Partners during the 2nd quarter worth approximately $45,000. Atria Wealth Solutions Inc. boosted its stake in shares of TXO Partners by 25.0% during the 2nd quarter. Atria Wealth Solutions Inc. now owns 15,000 shares of the company's stock worth $229,000 after acquiring an additional 3,000 shares during the period. Total Wealth Planning & Management Inc. boosted its stake in shares of TXO Partners by 3.6% during the 1st quarter. Total Wealth Planning & Management Inc. now owns 93,334 shares of the company's stock worth $1,788,000 after acquiring an additional 3,274 shares during the period. CWM LLC bought a new position in shares of TXO Partners during the 1st quarter worth approximately $77,000. Finally, M&T Bank Corp boosted its stake in shares of TXO Partners by 33.3% during the 2nd quarter. M&T Bank Corp now owns 20,000 shares of the company's stock worth $301,000 after acquiring an additional 5,000 shares during the period. Institutional investors and hedge funds own 27.44% of the company's stock.

TXO Partners Cuts Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, August 22nd. Investors of record on Friday, August 15th were given a $0.45 dividend. This represents a $1.80 dividend on an annualized basis and a yield of 13.3%. The ex-dividend date of this dividend was Friday, August 15th. TXO Partners's dividend payout ratio (DPR) is currently 545.45%.

About TXO Partners

(

Get Free Report)

TXO Partners, L.P., an oil and natural gas company, focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America. Its acreage positions are concentrated in the Permian Basin of West Texas and New Mexico and the San Juan Basin of New Mexico and Colorado.

See Also

Before you consider TXO Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TXO Partners wasn't on the list.

While TXO Partners currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.