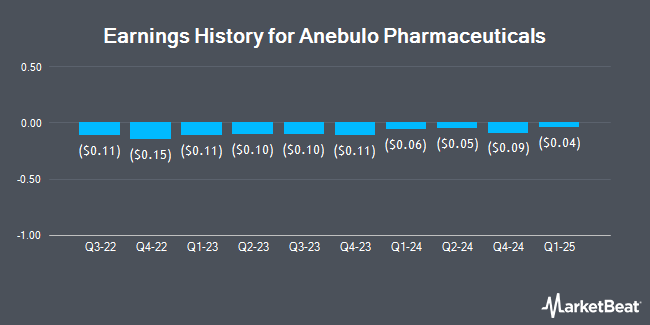

Anebulo Pharmaceuticals (NASDAQ:ANEB - Get Free Report) is expected to be issuing its Q4 2025 results before the market opens on Wednesday, September 24th. Analysts expect the company to announce earnings of ($0.05) per share for the quarter. Parties may visit the the company's upcoming Q4 2025 earningresults page for the latest details on the call scheduled for Monday, September 22, 2025 at 4:00 PM ET.

Anebulo Pharmaceuticals Price Performance

Anebulo Pharmaceuticals stock traded up $0.05 during trading hours on Friday, reaching $2.52. The company had a trading volume of 275,508 shares, compared to its average volume of 125,337. The company has a 50-day moving average price of $2.44 and a 200 day moving average price of $1.67. The firm has a market cap of $103.52 million, a price-to-earnings ratio of -9.69 and a beta of -0.89. Anebulo Pharmaceuticals has a 12-month low of $0.80 and a 12-month high of $3.42.

Wall Street Analyst Weigh In

Separately, Maxim Group cut Anebulo Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 23rd. One equities research analyst has rated the stock with a Buy rating and one has given a Hold rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $5.50.

View Our Latest Stock Analysis on ANEB

Institutional Investors Weigh In On Anebulo Pharmaceuticals

An institutional investor recently bought a new position in Anebulo Pharmaceuticals stock. Goldman Sachs Group Inc. bought a new position in Anebulo Pharmaceuticals, Inc. (NASDAQ:ANEB - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund bought 47,954 shares of the company's stock, valued at approximately $62,000. Goldman Sachs Group Inc. owned approximately 0.12% of Anebulo Pharmaceuticals at the end of the most recent quarter. Institutional investors and hedge funds own 28.40% of the company's stock.

Anebulo Pharmaceuticals Company Profile

(

Get Free Report)

Anebulo Pharmaceuticals, Inc, a clinical-stage biotechnology company, engages in developing solutions for people suffering from acute cannabinoid intoxication (ACI) and substance addiction. The company's lead product candidate is ANEB-001, a small molecule cannabinoid receptor antagonist, which is in a Phase II clinical trial to address the unmet medical need for a specific antidote for ACI.

See Also

Before you consider Anebulo Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anebulo Pharmaceuticals wasn't on the list.

While Anebulo Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.