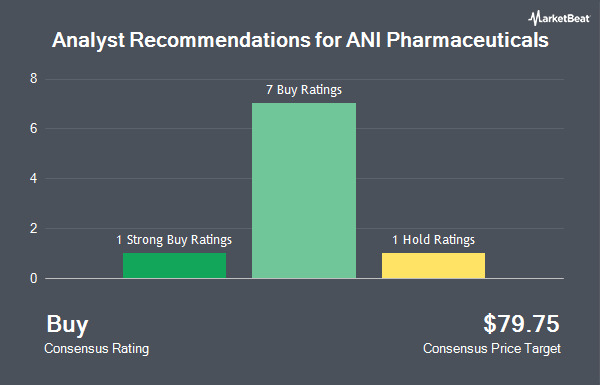

Shares of ANI Pharmaceuticals, Inc. (NASDAQ:ANIP - Get Free Report) have been given a consensus recommendation of "Buy" by the nine ratings firms that are currently covering the company, MarketBeat Ratings reports. One equities research analyst has rated the stock with a hold recommendation, seven have given a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $80.13.

A number of equities research analysts have recently commented on the company. Jefferies Financial Group assumed coverage on ANI Pharmaceuticals in a research report on Friday, March 14th. They set a "buy" rating and a $80.00 target price on the stock. StockNews.com downgraded ANI Pharmaceuticals from a "hold" rating to a "sell" rating in a research note on Thursday, April 24th. JPMorgan Chase & Co. started coverage on ANI Pharmaceuticals in a research report on Wednesday, March 12th. They set an "overweight" rating and a $85.00 target price on the stock. Truist Financial boosted their price target on shares of ANI Pharmaceuticals from $62.00 to $65.00 and gave the stock a "hold" rating in a report on Monday, April 21st. Finally, Guggenheim reiterated a "buy" rating and issued a $86.00 target price on shares of ANI Pharmaceuticals in a research report on Friday, April 11th.

Check Out Our Latest Report on ANI Pharmaceuticals

Insider Activity at ANI Pharmaceuticals

In other news, VP Meredith Cook sold 400 shares of the business's stock in a transaction dated Thursday, March 13th. The shares were sold at an average price of $63.33, for a total transaction of $25,332.00. Following the transaction, the vice president now owns 80,545 shares of the company's stock, valued at approximately $5,100,914.85. The trade was a 0.49 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, SVP Krista Davis sold 1,000 shares of the firm's stock in a transaction dated Friday, February 21st. The stock was sold at an average price of $60.20, for a total transaction of $60,200.00. Following the sale, the senior vice president now owns 68,624 shares of the company's stock, valued at approximately $4,131,164.80. The trade was a 1.44 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 3,200 shares of company stock valued at $197,792. Corporate insiders own 12.70% of the company's stock.

Institutional Investors Weigh In On ANI Pharmaceuticals

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Wakefield Asset Management LLLP acquired a new position in ANI Pharmaceuticals in the first quarter valued at about $1,155,000. Legato Capital Management LLC raised its position in ANI Pharmaceuticals by 198.8% in the first quarter. Legato Capital Management LLC now owns 18,050 shares of the specialty pharmaceutical company's stock valued at $1,208,000 after purchasing an additional 12,010 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in ANI Pharmaceuticals during the first quarter worth $3,794,000. Allianz Asset Management GmbH purchased a new position in shares of ANI Pharmaceuticals during the first quarter worth $415,000. Finally, Victory Capital Management Inc. raised its holdings in shares of ANI Pharmaceuticals by 22.4% in the 1st quarter. Victory Capital Management Inc. now owns 16,863 shares of the specialty pharmaceutical company's stock valued at $1,129,000 after buying an additional 3,086 shares during the period. Hedge funds and other institutional investors own 76.05% of the company's stock.

ANI Pharmaceuticals Stock Performance

NASDAQ ANIP traded down $2.29 during mid-day trading on Thursday, reaching $70.27. 649,221 shares of the stock were exchanged, compared to its average volume of 287,081. ANI Pharmaceuticals has a 1 year low of $52.50 and a 1 year high of $73.72. The company has a debt-to-equity ratio of 1.52, a quick ratio of 1.97 and a current ratio of 2.74. The business's 50 day moving average is $66.27 and its 200-day moving average is $60.48. The company has a market capitalization of $1.53 billion, a P/E ratio of -127.76 and a beta of 0.56.

ANI Pharmaceuticals Company Profile

(

Get Free ReportANI Pharmaceuticals, Inc, a biopharmaceutical company, develops, manufactures, and markets branded and generic prescription pharmaceuticals in the United States and Canada. The company manufactures oral solid dose products; semi-solids, liquids, and topicals; controlled substances; and potent products, as well as performs contract development and manufacturing of pharmaceutical products.

See Also

Before you consider ANI Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANI Pharmaceuticals wasn't on the list.

While ANI Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.