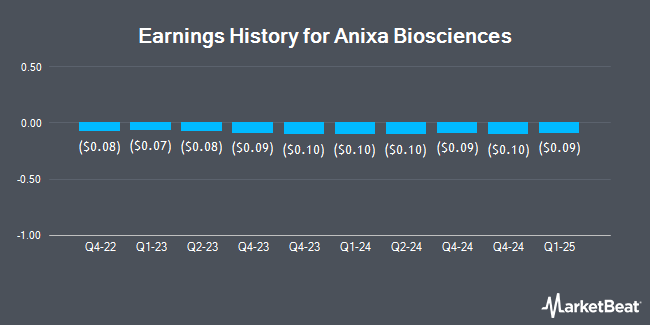

Anixa Biosciences (NASDAQ:ANIX - Get Free Report) is projected to issue its Q3 2025 results before the market opens on Friday, September 5th. Analysts expect the company to announce earnings of ($0.10) per share for the quarter. Interested persons may review the information on the company's upcoming Q3 2025 earningreport for the latest details on the call scheduled for Wednesday, September 10, 2025 at 4:00 PM ET.

Anixa Biosciences (NASDAQ:ANIX - Get Free Report) last posted its quarterly earnings results on Tuesday, June 3rd. The company reported ($0.09) earnings per share for the quarter, topping analysts' consensus estimates of ($0.10) by $0.01.

Anixa Biosciences Stock Performance

Shares of NASDAQ:ANIX traded down $0.02 during midday trading on Friday, hitting $2.99. 19,455 shares of the stock were exchanged, compared to its average volume of 72,818. The company has a market capitalization of $96.31 million, a PE ratio of -7.87 and a beta of 0.43. Anixa Biosciences has a 52-week low of $2.07 and a 52-week high of $4.20. The business's fifty day simple moving average is $3.16 and its two-hundred day simple moving average is $2.97.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently weighed in on the company. Wall Street Zen raised Anixa Biosciences from a "sell" rating to a "hold" rating in a research note on Friday, June 6th. D. Boral Capital restated a "buy" rating and issued a $10.00 price objective on shares of Anixa Biosciences in a report on Tuesday, August 19th. Three research analysts have rated the stock with a Buy rating, Based on data from MarketBeat.com, Anixa Biosciences has a consensus rating of "Buy" and an average target price of $9.00.

Read Our Latest Analysis on ANIX

Insider Activity

In related news, CEO Amit Kumar purchased 10,000 shares of the firm's stock in a transaction dated Wednesday, June 4th. The stock was bought at an average price of $2.85 per share, for a total transaction of $28,500.00. Following the purchase, the chief executive officer owned 569,925 shares in the company, valued at $1,624,286.25. The trade was a 1.79% increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Lewis H. Titterton, Jr. purchased 10,000 shares of the firm's stock in a transaction dated Thursday, July 31st. The shares were bought at an average price of $3.08 per share, with a total value of $30,800.00. Following the purchase, the director owned 953,334 shares in the company, valued at $2,936,268.72. This represents a 1.06% increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders have bought 45,000 shares of company stock valued at $139,200. 25.30% of the stock is currently owned by corporate insiders.

Institutional Trading of Anixa Biosciences

Several large investors have recently made changes to their positions in ANIX. NewEdge Advisors LLC bought a new stake in shares of Anixa Biosciences during the 2nd quarter worth about $33,000. Benjamin Edwards Inc. bought a new position in shares of Anixa Biosciences in the second quarter worth about $37,000. Marshall Wace LLP bought a new position in shares of Anixa Biosciences in the second quarter worth about $39,000. Finally, Jane Street Group LLC increased its stake in shares of Anixa Biosciences by 37.2% in the second quarter. Jane Street Group LLC now owns 41,800 shares of the company's stock worth $138,000 after purchasing an additional 11,340 shares during the period. Institutional investors own 29.13% of the company's stock.

About Anixa Biosciences

(

Get Free Report)

Anixa Biosciences, Inc, a biotechnology company, develops therapies and vaccines focusing on critical unmet needs in oncology and infectious diseases. The company's therapeutics programs include the development of a chimeric endocrine receptor T-cell therapy, a novel form of chimeric antigen receptor T-cell (CAR-T) technology focusing on the treatment of ovarian cancer.

See Also

Before you consider Anixa Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anixa Biosciences wasn't on the list.

While Anixa Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.