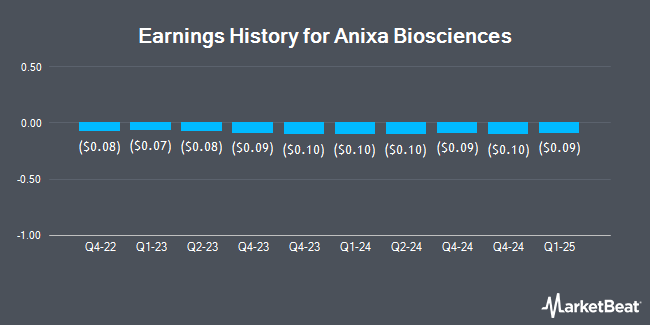

Anixa Biosciences (NASDAQ:ANIX - Get Free Report) posted its earnings results on Wednesday. The company reported ($0.07) EPS for the quarter, topping the consensus estimate of ($0.10) by $0.03, Zacks reports.

Anixa Biosciences Price Performance

Shares of NASDAQ ANIX traded up $0.59 during mid-day trading on Monday, hitting $3.52. The company had a trading volume of 579,631 shares, compared to its average volume of 61,894. The business's 50-day simple moving average is $3.10 and its 200-day simple moving average is $2.97. Anixa Biosciences has a 12 month low of $2.07 and a 12 month high of $4.20. The firm has a market cap of $115.88 million, a P/E ratio of -10.06 and a beta of 0.58.

Analyst Upgrades and Downgrades

Several equities analysts have commented on the stock. D. Boral Capital reissued a "buy" rating and set a $10.00 target price on shares of Anixa Biosciences in a research report on Tuesday, September 9th. HC Wainwright reissued a "buy" rating and set a $7.00 target price on shares of Anixa Biosciences in a research report on Thursday. Finally, Wall Street Zen raised shares of Anixa Biosciences from a "sell" rating to a "hold" rating in a research report on Friday, June 6th. Three equities research analysts have rated the stock with a Buy rating, According to MarketBeat, the company presently has a consensus rating of "Buy" and a consensus target price of $9.00.

View Our Latest Stock Analysis on ANIX

Insider Buying and Selling at Anixa Biosciences

In related news, Director Lewis H. Titterton, Jr. bought 10,000 shares of Anixa Biosciences stock in a transaction that occurred on Thursday, July 31st. The stock was acquired at an average price of $3.08 per share, for a total transaction of $30,800.00. Following the completion of the purchase, the director owned 953,334 shares in the company, valued at approximately $2,936,268.72. This represents a 1.06% increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Insiders have bought a total of 35,000 shares of company stock valued at $110,700 in the last three months. 25.30% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Anixa Biosciences

Several hedge funds have recently made changes to their positions in ANIX. NewEdge Advisors LLC bought a new stake in shares of Anixa Biosciences in the second quarter valued at about $33,000. Benjamin Edwards Inc. acquired a new position in Anixa Biosciences in the second quarter worth about $37,000. Marshall Wace LLP acquired a new position in Anixa Biosciences in the second quarter worth about $39,000. Finally, Jane Street Group LLC raised its position in Anixa Biosciences by 37.2% in the second quarter. Jane Street Group LLC now owns 41,800 shares of the company's stock worth $138,000 after purchasing an additional 11,340 shares in the last quarter. Institutional investors own 29.13% of the company's stock.

About Anixa Biosciences

(

Get Free Report)

Anixa Biosciences, Inc, a biotechnology company, develops therapies and vaccines focusing on critical unmet needs in oncology and infectious diseases. The company's therapeutics programs include the development of a chimeric endocrine receptor T-cell therapy, a novel form of chimeric antigen receptor T-cell (CAR-T) technology focusing on the treatment of ovarian cancer.

Featured Articles

Before you consider Anixa Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anixa Biosciences wasn't on the list.

While Anixa Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.