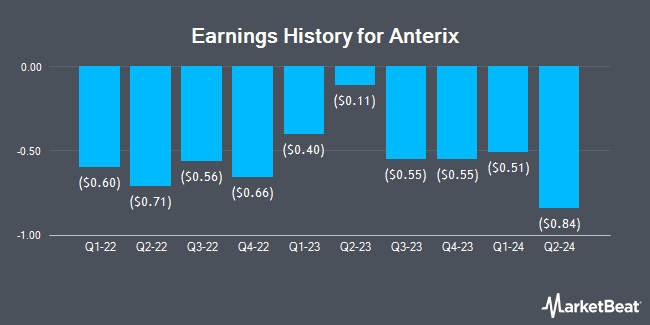

Anterix (NASDAQ:ATEX - Get Free Report) announced its quarterly earnings results on Tuesday. The company reported ($0.48) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.54) by $0.06, Zacks reports. The firm had revenue of $1.42 million during the quarter, compared to analysts' expectations of $1.51 million. Anterix had a net margin of 495.14% and a negative return on equity of 23.87%.

Anterix Trading Up 3.0%

Shares of ATEX traded up $0.65 during mid-day trading on Friday, reaching $22.34. The company's stock had a trading volume of 281,335 shares, compared to its average volume of 193,942. Anterix has a 52 week low of $20.61 and a 52 week high of $42.91. The company's fifty day moving average price is $24.24 and its two-hundred day moving average price is $29.99. The stock has a market cap of $418.65 million, a PE ratio of 14.32 and a beta of 0.89.

Analyst Ratings Changes

Separately, Wall Street Zen lowered shares of Anterix from a "hold" rating to a "sell" rating in a research report on Saturday.

View Our Latest Stock Analysis on Anterix

Institutional Trading of Anterix

A number of hedge funds and other institutional investors have recently modified their holdings of the business. AQR Capital Management LLC grew its holdings in Anterix by 16.9% during the 1st quarter. AQR Capital Management LLC now owns 11,489 shares of the company's stock valued at $420,000 after buying an additional 1,659 shares in the last quarter. Millennium Management LLC grew its stake in shares of Anterix by 50.6% during the 1st quarter. Millennium Management LLC now owns 116,473 shares of the company's stock worth $4,263,000 after purchasing an additional 39,143 shares during the period. Goldman Sachs Group Inc. lifted its position in shares of Anterix by 17.7% during the 1st quarter. Goldman Sachs Group Inc. now owns 124,706 shares of the company's stock valued at $4,564,000 after buying an additional 18,771 shares in the last quarter. Legal & General Group Plc increased its stake in shares of Anterix by 19.7% in the 2nd quarter. Legal & General Group Plc now owns 11,303 shares of the company's stock worth $290,000 after acquiring an additional 1,857 shares during the last quarter. Finally, Rhumbline Advisers increased its position in shares of Anterix by 70.9% during the 2nd quarter. Rhumbline Advisers now owns 27,998 shares of the company's stock worth $718,000 after purchasing an additional 11,615 shares during the last quarter. 87.67% of the stock is owned by hedge funds and other institutional investors.

About Anterix

(

Get Free Report)

Anterix Inc operates as a wireless communications company. The company focuses on commercializing its spectrum assets to enable the targeted utility and critical infrastructure customers to deploy private broadband networks and innovative broadband solutions. It holds licensed spectrum in the 900 MHz band with coverage throughout the United States, Alaska, Hawaii, and Puerto Rico.

See Also

Before you consider Anterix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anterix wasn't on the list.

While Anterix currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.