APi Group (NYSE:APG - Get Free Report) is projected to issue its Q2 2025 quarterly earnings data before the market opens on Thursday, July 31st. Analysts expect the company to announce earnings of $0.56 per share and revenue of $1.88 billion for the quarter. APi Group has set its Q2 2025 guidance at EPS and its FY 2025 guidance at EPS.

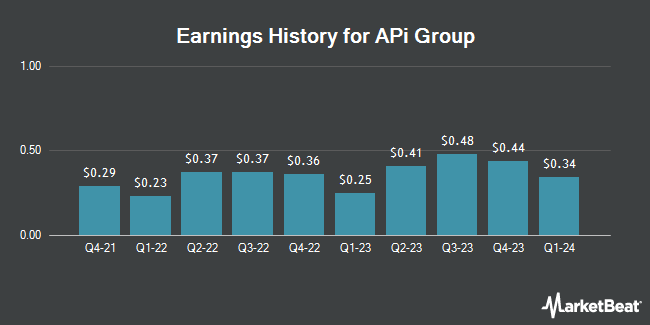

APi Group (NYSE:APG - Get Free Report) last issued its earnings results on Thursday, May 1st. The company reported $0.25 EPS for the quarter, topping the consensus estimate of $0.23 by $0.02. The company had revenue of $1.72 billion for the quarter, compared to analyst estimates of $1.66 billion. APi Group had a net margin of 3.36% and a return on equity of 20.99%. The business's revenue was up 7.4% on a year-over-year basis. During the same period in the previous year, the firm earned $0.23 EPS. On average, analysts expect APi Group to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

APi Group Price Performance

Shares of NYSE APG traded up $0.42 during trading on Friday, hitting $35.11. 3,322,171 shares of the company were exchanged, compared to its average volume of 2,621,893. The company has a market cap of $14.58 billion, a price-to-earnings ratio of 114.49 and a beta of 1.58. APi Group has a 1 year low of $20.50 and a 1 year high of $35.51. The firm's fifty day moving average price is $32.96 and its 200 day moving average price is $27.89. The company has a debt-to-equity ratio of 0.92, a current ratio of 1.47 and a quick ratio of 1.38.

Insiders Place Their Bets

In other APi Group news, Director Ian G. H. Ashken sold 225,000 shares of the stock in a transaction on Monday, May 5th. The stock was sold at an average price of $28.48, for a total value of $6,408,000.00. Following the sale, the director directly owned 8,418,153 shares of the company's stock, valued at $239,748,997.44. This trade represents a 2.60% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 17.00% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

An institutional investor recently raised its position in APi Group stock. Goldman Sachs Group Inc. lifted its holdings in APi Group Corporation (NYSE:APG - Free Report) by 73.6% in the 1st quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 178,117 shares of the company's stock after purchasing an additional 75,490 shares during the quarter. Goldman Sachs Group Inc. owned 0.06% of APi Group worth $6,369,000 as of its most recent filing with the SEC. Institutional investors own 86.62% of the company's stock.

Analyst Ratings Changes

APG has been the subject of several research reports. Wall Street Zen raised APi Group from a "hold" rating to a "buy" rating in a research note on Sunday, July 13th. Barclays decreased their target price on APi Group to $40.00 and set an "overweight" rating for the company in a report on Wednesday, July 9th. JPMorgan Chase & Co. upgraded APi Group from a "neutral" rating to an "overweight" rating and upped their price target for the stock from $31.00 to $42.00 in a report on Tuesday, July 15th. Royal Bank Of Canada reissued an "outperform" rating and set a $34.67 price target on shares of APi Group in a research report on Friday, June 27th. Finally, Truist Financial upped their price target on APi Group from $32.00 to $36.00 and gave the company a "buy" rating in a research report on Thursday, May 22nd. Nine equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and a consensus target price of $35.81.

View Our Latest Analysis on APi Group

APi Group Company Profile

(

Get Free Report)

APi Group Corporation provides safety and specialty services worldwide. It operates through Safety Services and Specialty Services segments. The Safety Services segment offers solutions focusing on end-to-end integrated occupancy systems, such as fire protection services; heating, ventilation, and air conditioning solutions; and entry systems, which include the design, installation, inspection, and service of these integrated systems.

See Also

Before you consider APi Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APi Group wasn't on the list.

While APi Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.