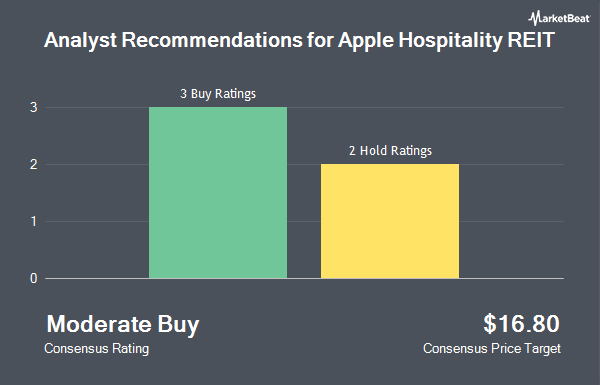

Shares of Apple Hospitality REIT, Inc. (NYSE:APLE - Get Free Report) have received a consensus rating of "Moderate Buy" from the five analysts that are currently covering the company, Marketbeat.com reports. Two equities research analysts have rated the stock with a hold recommendation and three have assigned a buy recommendation to the company. The average 12-month target price among brokerages that have issued ratings on the stock in the last year is $16.80.

APLE has been the subject of several analyst reports. Wells Fargo & Company dropped their target price on Apple Hospitality REIT from $17.00 to $16.00 and set an "equal weight" rating for the company in a report on Tuesday, February 18th. Bank of America upgraded shares of Apple Hospitality REIT from a "neutral" rating to a "buy" rating and raised their target price for the stock from $16.00 to $17.00 in a report on Monday, January 27th.

Check Out Our Latest Stock Analysis on APLE

Apple Hospitality REIT Price Performance

APLE traded up $0.35 during midday trading on Friday, hitting $11.87. The stock had a trading volume of 2,900,750 shares, compared to its average volume of 2,204,708. The company has a market cap of $2.84 billion, a P/E ratio of 13.97 and a beta of 1.00. Apple Hospitality REIT has a 1 year low of $10.44 and a 1 year high of $16.50. The business has a fifty day moving average of $13.44 and a 200 day moving average of $14.73. The company has a debt-to-equity ratio of 0.03, a quick ratio of 0.04 and a current ratio of 0.04.

Apple Hospitality REIT (NYSE:APLE - Get Free Report) last posted its quarterly earnings results on Monday, February 24th. The real estate investment trust reported $0.32 earnings per share for the quarter, topping the consensus estimate of $0.31 by $0.01. Apple Hospitality REIT had a net margin of 14.53% and a return on equity of 6.17%. The business had revenue of $333.04 million during the quarter, compared to the consensus estimate of $330.11 million. As a group, equities analysts forecast that Apple Hospitality REIT will post 1.6 earnings per share for the current fiscal year.

Apple Hospitality REIT Dividend Announcement

The business also recently declared a monthly dividend, which was paid on Tuesday, April 15th. Investors of record on Monday, March 31st were issued a $0.08 dividend. This represents a $0.96 annualized dividend and a yield of 8.08%. The ex-dividend date of this dividend was Monday, March 31st. Apple Hospitality REIT's dividend payout ratio (DPR) is currently 109.09%.

Institutional Investors Weigh In On Apple Hospitality REIT

Several institutional investors and hedge funds have recently modified their holdings of APLE. Summit Investment Advisors Inc. lifted its holdings in Apple Hospitality REIT by 3.3% in the fourth quarter. Summit Investment Advisors Inc. now owns 23,850 shares of the real estate investment trust's stock worth $366,000 after buying an additional 755 shares during the period. Quadrant Capital Group LLC raised its position in shares of Apple Hospitality REIT by 20.1% in the 4th quarter. Quadrant Capital Group LLC now owns 6,740 shares of the real estate investment trust's stock worth $104,000 after acquiring an additional 1,128 shares in the last quarter. Inspire Advisors LLC lifted its stake in shares of Apple Hospitality REIT by 8.5% in the 4th quarter. Inspire Advisors LLC now owns 14,502 shares of the real estate investment trust's stock valued at $223,000 after purchasing an additional 1,137 shares during the period. Keybank National Association OH boosted its position in shares of Apple Hospitality REIT by 3.1% during the fourth quarter. Keybank National Association OH now owns 40,163 shares of the real estate investment trust's stock valued at $617,000 after purchasing an additional 1,218 shares in the last quarter. Finally, Hudson Edge Investment Partners Inc. boosted its position in shares of Apple Hospitality REIT by 4.9% during the fourth quarter. Hudson Edge Investment Partners Inc. now owns 27,079 shares of the real estate investment trust's stock valued at $416,000 after purchasing an additional 1,272 shares in the last quarter. 89.66% of the stock is owned by hedge funds and other institutional investors.

Apple Hospitality REIT Company Profile

(

Get Free ReportApple Hospitality REIT, Inc NYSE: APLE is a publicly traded real estate investment trust (REIT) that owns one of the largest and most diverse portfolios of upscale, rooms-focused hotels in the United States. Apple Hospitality's portfolio consists of 223 hotels with more than 29,400 guest rooms located in 87 markets throughout 37 states as well as one property leased to third parties.

Featured Articles

Before you consider Apple Hospitality REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple Hospitality REIT wasn't on the list.

While Apple Hospitality REIT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.