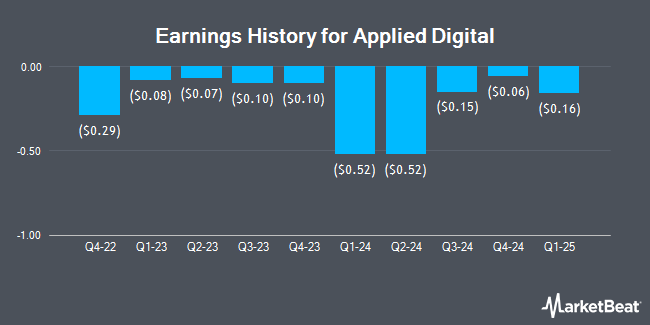

Applied Digital (NASDAQ:APLD - Get Free Report) posted its quarterly earnings data on Thursday. The company reported ($0.03) earnings per share for the quarter, topping the consensus estimate of ($0.11) by $0.08, Briefing.com reports. The business had revenue of $38.01 million for the quarter, compared to analysts' expectations of $52.25 million. Applied Digital had a negative return on equity of 50.03% and a negative net margin of 107.22%.The business's revenue was up 84.3% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($0.15) earnings per share.

Applied Digital Price Performance

Shares of APLD stock traded up $1.35 during trading on Thursday, reaching $29.29. 39,805,837 shares of the company's stock traded hands, compared to its average volume of 28,545,108. The company has a debt-to-equity ratio of 1.36, a quick ratio of 0.77 and a current ratio of 0.77. The firm's 50-day moving average is $18.50 and its 200 day moving average is $11.62. Applied Digital has a 1 year low of $3.31 and a 1 year high of $29.98.

Analyst Ratings Changes

APLD has been the topic of a number of recent analyst reports. Compass Point initiated coverage on Applied Digital in a research note on Monday, September 15th. They set a "buy" rating on the stock. Needham & Company LLC lifted their price objective on shares of Applied Digital from $12.00 to $16.00 and gave the stock a "buy" rating in a research report on Thursday, July 31st. Lake Street Capital lifted their price objective on shares of Applied Digital from $14.00 to $18.00 and gave the stock a "buy" rating in a research report on Thursday, July 31st. Craig Hallum lifted their price objective on shares of Applied Digital from $12.00 to $23.00 and gave the stock a "buy" rating in a research report on Monday, August 18th. Finally, HC Wainwright lifted their price objective on shares of Applied Digital from $15.00 to $20.00 and gave the stock a "buy" rating in a research report on Monday, August 25th. One research analyst has rated the stock with a Strong Buy rating, twelve have assigned a Buy rating and one has issued a Sell rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $15.64.

Read Our Latest Stock Report on APLD

Insider Buying and Selling

In related news, Director Richard N. Nottenburg sold 20,000 shares of the company's stock in a transaction that occurred on Wednesday, September 3rd. The shares were sold at an average price of $15.26, for a total transaction of $305,200.00. Following the sale, the director owned 297,987 shares of the company's stock, valued at approximately $4,547,281.62. This represents a 6.29% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, CFO Mohammad Saidal Lavanw Mohmand sold 75,000 shares of the company's stock in a transaction that occurred on Wednesday, September 3rd. The stock was sold at an average price of $15.26, for a total transaction of $1,144,500.00. Following the sale, the chief financial officer directly owned 201,800 shares in the company, valued at $3,079,468. This trade represents a 27.10% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 506,250 shares of company stock valued at $7,713,675. Company insiders own 9.50% of the company's stock.

Institutional Trading of Applied Digital

Hedge funds and other institutional investors have recently bought and sold shares of the company. BNP Paribas Financial Markets increased its holdings in shares of Applied Digital by 24,356.8% in the 2nd quarter. BNP Paribas Financial Markets now owns 5,219,565 shares of the company's stock worth $52,561,000 after buying an additional 5,198,223 shares during the last quarter. Situational Awareness LP increased its holdings in shares of Applied Digital by 63.3% in the 2nd quarter. Situational Awareness LP now owns 6,591,800 shares of the company's stock worth $66,379,000 after buying an additional 2,556,200 shares during the last quarter. HRT Financial LP bought a new position in shares of Applied Digital in the 2nd quarter worth $14,759,000. Shellback Capital LP bought a new position in shares of Applied Digital in the 2nd quarter worth $9,063,000. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its holdings in shares of Applied Digital by 24.0% in the 2nd quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,661,296 shares of the company's stock worth $26,799,000 after buying an additional 514,896 shares during the last quarter. Institutional investors own 65.67% of the company's stock.

About Applied Digital

(

Get Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.