Ares Management (NYSE:ARES - Get Free Report) had its price target raised by research analysts at Keefe, Bruyette & Woods from $193.00 to $203.00 in a research report issued to clients and investors on Monday,Benzinga reports. The firm presently has an "outperform" rating on the asset manager's stock. Keefe, Bruyette & Woods' price target would suggest a potential upside of 10.87% from the company's previous close.

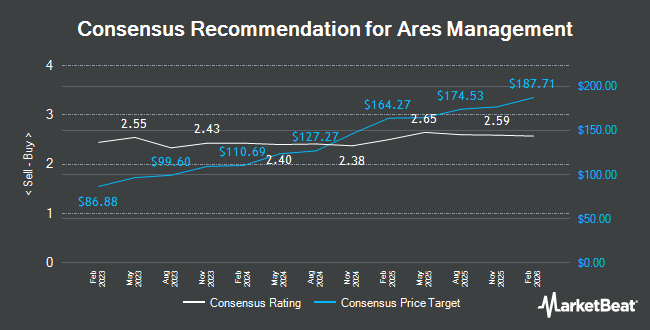

Other research analysts have also issued reports about the stock. TD Cowen reduced their target price on shares of Ares Management from $216.00 to $161.00 and set a "buy" rating on the stock in a report on Wednesday, April 9th. Morgan Stanley reduced their price objective on shares of Ares Management from $197.00 to $152.00 and set an "equal weight" rating on the stock in a research note on Monday, April 14th. Citizens Jmp upgraded shares of Ares Management from a "market perform" rating to an "outperform" rating and set a $165.00 target price on the stock in a research report on Tuesday, April 8th. Wolfe Research set a $193.00 price target on Ares Management and gave the company an "outperform" rating in a report on Tuesday, May 6th. Finally, Wells Fargo & Company increased their price target on Ares Management from $189.00 to $202.00 and gave the stock an "overweight" rating in a research note on Friday, July 11th. One research analyst has rated the stock with a sell rating, five have assigned a hold rating and thirteen have given a buy rating to the company. According to data from MarketBeat, Ares Management currently has a consensus rating of "Moderate Buy" and a consensus price target of $177.56.

Get Our Latest Research Report on Ares Management

Ares Management Trading Down 1.3%

Shares of Ares Management stock opened at $183.10 on Monday. Ares Management has a 1 year low of $110.63 and a 1 year high of $200.49. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.07 and a quick ratio of 1.07. The business has a 50 day moving average price of $174.04 and a 200 day moving average price of $166.55. The company has a market capitalization of $59.80 billion, a P/E ratio of 105.84, a P/E/G ratio of 1.50 and a beta of 1.40.

Ares Management (NYSE:ARES - Get Free Report) last released its quarterly earnings results on Friday, August 1st. The asset manager reported $1.03 earnings per share for the quarter, missing analysts' consensus estimates of $1.15 by ($0.12). Ares Management had a return on equity of 16.49% and a net margin of 9.47%. The company had revenue of $1.35 billion during the quarter, compared to analyst estimates of $1.02 billion. During the same period last year, the firm earned $0.99 earnings per share. Sell-side analysts anticipate that Ares Management will post 5.28 EPS for the current fiscal year.

Insider Activity

In related news, Chairman Bennett Rosenthal sold 85,000 shares of the firm's stock in a transaction that occurred on Thursday, June 12th. The shares were sold at an average price of $168.79, for a total value of $14,347,150.00. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Michael J. Arougheti sold 182,108 shares of the business's stock in a transaction that occurred on Friday, May 16th. The stock was sold at an average price of $170.07, for a total transaction of $30,971,107.56. Following the sale, the chief executive officer owned 350,684 shares of the company's stock, valued at approximately $59,640,827.88. This represents a 34.18% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 873,145 shares of company stock valued at $146,204,353 in the last three months. Corporate insiders own 0.52% of the company's stock.

Hedge Funds Weigh In On Ares Management

A number of hedge funds have recently made changes to their positions in ARES. New York Life Investment Management LLC increased its holdings in Ares Management by 2.0% in the 2nd quarter. New York Life Investment Management LLC now owns 3,083 shares of the asset manager's stock valued at $534,000 after purchasing an additional 59 shares in the last quarter. Private Wealth Partners LLC purchased a new stake in shares of Ares Management in the second quarter worth about $977,000. Fjarde AP Fonden Fourth Swedish National Pension Fund boosted its position in shares of Ares Management by 28.1% in the second quarter. Fjarde AP Fonden Fourth Swedish National Pension Fund now owns 41,900 shares of the asset manager's stock worth $7,257,000 after buying an additional 9,200 shares during the period. Guinness Asset Management LTD grew its stake in shares of Ares Management by 2.4% in the second quarter. Guinness Asset Management LTD now owns 4,728 shares of the asset manager's stock valued at $819,000 after buying an additional 109 shares in the last quarter. Finally, Teacher Retirement System of Texas raised its holdings in shares of Ares Management by 12.4% during the 2nd quarter. Teacher Retirement System of Texas now owns 30,956 shares of the asset manager's stock valued at $5,362,000 after buying an additional 3,404 shares during the period. Hedge funds and other institutional investors own 50.03% of the company's stock.

About Ares Management

(

Get Free Report)

Ares Management Corporation operates as an alternative asset manager in the United States, Europe, and Asia. The company's Tradable Credit Group segment manages various types of investment funds, such as commingled and separately managed accounts for institutional investors, and publicly traded vehicles and sub-advised funds for retail investors in the tradable and non-investment grade corporate credit markets.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ares Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ares Management wasn't on the list.

While Ares Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.