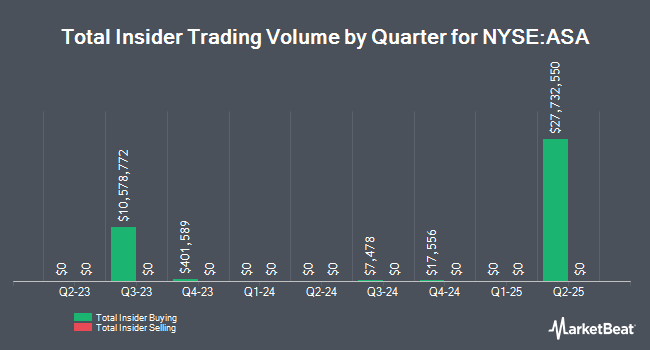

ASA Gold and Precious Metals Limited (NYSE:ASA - Get Free Report) major shareholder Saba Capital Management, L.P. bought 109,206 shares of the business's stock in a transaction on Friday, September 12th. The stock was bought at an average cost of $40.91 per share, for a total transaction of $4,467,617.46. Following the purchase, the insider directly owned 4,516,387 shares of the company's stock, valued at approximately $184,765,392.17. This trade represents a 2.48% increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Large shareholders that own more than 10% of a company's stock are required to disclose their transactions with the SEC.

Saba Capital Management, L.P. also recently made the following trade(s):

- On Thursday, September 18th, Saba Capital Management, L.P. bought 9,200 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $40.64 per share, for a total transaction of $373,888.00.

- On Wednesday, September 17th, Saba Capital Management, L.P. bought 16,670 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $41.30 per share, for a total transaction of $688,471.00.

- On Tuesday, September 16th, Saba Capital Management, L.P. bought 91,385 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $41.50 per share, for a total transaction of $3,792,477.50.

- On Monday, September 15th, Saba Capital Management, L.P. bought 17,256 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $41.39 per share, for a total transaction of $714,225.84.

- On Thursday, September 11th, Saba Capital Management, L.P. bought 96,286 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $40.40 per share, for a total transaction of $3,889,954.40.

- On Wednesday, September 10th, Saba Capital Management, L.P. bought 19,126 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $40.34 per share, for a total transaction of $771,542.84.

- On Tuesday, September 9th, Saba Capital Management, L.P. bought 31,225 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $40.06 per share, for a total transaction of $1,250,873.50.

- On Monday, September 8th, Saba Capital Management, L.P. bought 24,510 shares of ASA Gold and Precious Metals stock. The shares were bought at an average price of $40.50 per share, for a total transaction of $992,655.00.

- On Wednesday, September 3rd, Saba Capital Management, L.P. purchased 30,460 shares of ASA Gold and Precious Metals stock. The shares were acquired at an average cost of $38.88 per share, for a total transaction of $1,184,284.80.

- On Tuesday, September 2nd, Saba Capital Management, L.P. purchased 70,108 shares of ASA Gold and Precious Metals stock. The shares were acquired at an average cost of $38.64 per share, for a total transaction of $2,708,973.12.

ASA Gold and Precious Metals Trading Up 3.4%

Shares of NYSE ASA traded up $1.38 during mid-day trading on Friday, reaching $42.35. 109,580 shares of the company's stock were exchanged, compared to its average volume of 166,519. The business has a fifty day simple moving average of $35.87 and a 200 day simple moving average of $32.05. ASA Gold and Precious Metals Limited has a twelve month low of $19.37 and a twelve month high of $42.57.

ASA Gold and Precious Metals Dividend Announcement

The firm also recently declared a dividend, which will be paid on Wednesday, November 19th. Stockholders of record on Wednesday, November 12th will be given a dividend of $0.03 per share. The ex-dividend date of this dividend is Wednesday, November 12th. This represents a dividend yield of 14.0%.

Institutional Investors Weigh In On ASA Gold and Precious Metals

Hedge funds have recently modified their holdings of the business. NBC Securities Inc. raised its position in shares of ASA Gold and Precious Metals by 128,600.0% during the first quarter. NBC Securities Inc. now owns 1,287 shares of the investment management company's stock worth $38,000 after purchasing an additional 1,286 shares during the period. JPMorgan Chase & Co. acquired a new stake in shares of ASA Gold and Precious Metals during the second quarter worth about $61,000. Wealthcare Advisory Partners LLC acquired a new stake in shares of ASA Gold and Precious Metals during the first quarter worth about $220,000. Fruth Investment Management acquired a new stake in ASA Gold and Precious Metals in the 1st quarter valued at approximately $226,000. Finally, Steward Partners Investment Advisory LLC raised its position in ASA Gold and Precious Metals by 143.4% in the 2nd quarter. Steward Partners Investment Advisory LLC now owns 7,252 shares of the investment management company's stock valued at $229,000 after buying an additional 4,272 shares during the last quarter.

About ASA Gold and Precious Metals

(

Get Free Report)

ASA Gold and Precious Metals Limited is a publicly owned investment manager. The firm invests in the public equity markets across the globe. It primarily invests in stocks of companies engaged in the exploration, mining or processing of gold, silver, platinum, diamonds, or other precious minerals. It also invests in exchange traded funds.

See Also

Before you consider ASA Gold and Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASA Gold and Precious Metals wasn't on the list.

While ASA Gold and Precious Metals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.