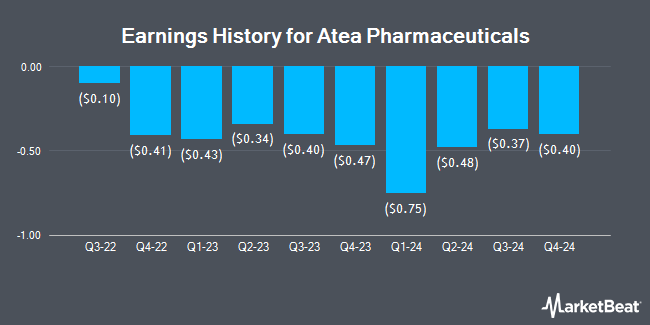

Atea Pharmaceuticals (NASDAQ:AVIR - Get Free Report) announced its earnings results on Thursday, August 7th. The company reported ($0.44) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.46) by $0.02, Zacks reports.

Atea Pharmaceuticals Stock Performance

NASDAQ AVIR traded down $0.01 during mid-day trading on Thursday, reaching $3.49. 308,417 shares of the stock were exchanged, compared to its average volume of 362,316. Atea Pharmaceuticals has a 1-year low of $2.45 and a 1-year high of $4.14. The business's fifty day simple moving average is $3.49 and its 200 day simple moving average is $3.14. The stock has a market capitalization of $276.97 million, a PE ratio of -2.17 and a beta of 0.25.

Analysts Set New Price Targets

Separately, Wall Street Zen lowered shares of Atea Pharmaceuticals from a "hold" rating to a "sell" rating in a research report on Saturday, August 9th.

Read Our Latest Stock Analysis on Atea Pharmaceuticals

Institutional Trading of Atea Pharmaceuticals

A number of hedge funds have recently bought and sold shares of the company. Rhumbline Advisers boosted its holdings in shares of Atea Pharmaceuticals by 2.6% in the 2nd quarter. Rhumbline Advisers now owns 119,420 shares of the company's stock valued at $430,000 after purchasing an additional 2,977 shares during the last quarter. Prudential Financial Inc. acquired a new position in shares of Atea Pharmaceuticals in the 2nd quarter valued at $36,000. American Century Companies Inc. boosted its holdings in shares of Atea Pharmaceuticals by 6.7% in the 2nd quarter. American Century Companies Inc. now owns 173,791 shares of the company's stock valued at $626,000 after purchasing an additional 10,930 shares during the last quarter. Marshall Wace LLP acquired a new position in shares of Atea Pharmaceuticals in the 2nd quarter valued at $90,000. Finally, Jane Street Group LLC boosted its holdings in shares of Atea Pharmaceuticals by 80.4% in the 1st quarter. Jane Street Group LLC now owns 102,607 shares of the company's stock valued at $307,000 after purchasing an additional 45,716 shares during the last quarter. Institutional investors and hedge funds own 86.67% of the company's stock.

Atea Pharmaceuticals Company Profile

(

Get Free Report)

Atea Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, discovers, develops, and commercializes antiviral therapeutics for patients with viral infections. Its lead product candidate is AT-527, an oral antiviral candidate that is in Phase 3 SUNRISE-3 clinical trial for the treatment of patients with COVID-19.

Featured Stories

Before you consider Atea Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atea Pharmaceuticals wasn't on the list.

While Atea Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.