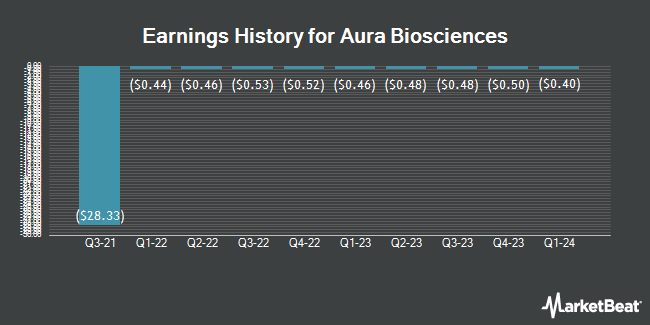

Aura Biosciences (NASDAQ:AURA - Get Free Report) is expected to be announcing its Q2 2025 earnings results before the market opens on Thursday, August 14th. Analysts expect the company to announce earnings of ($0.47) per share for the quarter.

Aura Biosciences (NASDAQ:AURA - Get Free Report) last released its earnings results on Thursday, May 15th. The company reported ($0.55) EPS for the quarter, missing the consensus estimate of ($0.47) by ($0.08). On average, analysts expect Aura Biosciences to post $-2 EPS for the current fiscal year and $-2 EPS for the next fiscal year.

Aura Biosciences Trading Up 3.2%

Shares of NASDAQ:AURA opened at $6.84 on Thursday. The company has a fifty day simple moving average of $6.52 and a 200 day simple moving average of $6.58. The firm has a market cap of $343.85 million, a PE ratio of -3.60 and a beta of 0.46. Aura Biosciences has a 12-month low of $4.34 and a 12-month high of $12.38.

Insider Transactions at Aura Biosciences

In other Aura Biosciences news, Director David Michael Johnson acquired 20,000 shares of the company's stock in a transaction that occurred on Friday, May 16th. The shares were purchased at an average price of $4.90 per share, for a total transaction of $98,000.00. Following the completion of the purchase, the director directly owned 166,167 shares in the company, valued at $814,218.30. The trade was a 13.68% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Also, insider Anthony S. Gibney bought 50,000 shares of the stock in a transaction dated Friday, May 16th. The shares were bought at an average cost of $4.90 per share, with a total value of $245,000.00. Following the completion of the acquisition, the insider directly owned 58,452 shares of the company's stock, valued at approximately $286,414.80. The trade was a 591.58% increase in their position. The disclosure for this purchase can be found here. 5.40% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On Aura Biosciences

A hedge fund recently bought a new stake in Aura Biosciences stock. Dynamic Technology Lab Private Ltd bought a new stake in shares of Aura Biosciences, Inc. (NASDAQ:AURA - Free Report) in the first quarter, according to its most recent Form 13F filing with the SEC. The fund bought 23,449 shares of the company's stock, valued at approximately $137,000. Institutional investors and hedge funds own 96.75% of the company's stock.

Analysts Set New Price Targets

Several research analysts have weighed in on AURA shares. HC Wainwright raised shares of Aura Biosciences to a "buy" rating and set a $22.00 price objective for the company in a report on Wednesday, May 28th. JMP Securities restated a "market outperform" rating and set a $19.00 price objective on shares of Aura Biosciences in a research note on Friday, May 23rd. Six analysts have rated the stock with a buy rating and two have issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $22.00.

View Our Latest Stock Report on AURA

About Aura Biosciences

(

Get Free Report)

Aura Biosciences, Inc, a clinical-stage biotechnology company, develops precision immunotherapies to treat a range of solid tumors. The company's proprietary platform enables the targeting of a range of solid tumors using virus-like particles conjugated with drugs or loaded with nucleic acids to create virus-like drug conjugates.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aura Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aura Biosciences wasn't on the list.

While Aura Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.