Avita Medical (NASDAQ:RCEL - Get Free Report) is anticipated to announce its Q2 2025 earnings results after the market closes on Thursday, August 7th. Analysts expect the company to announce earnings of ($0.26) per share and revenue of $34.27 million for the quarter. Avita Medical has set its FY 2025 guidance at EPS.

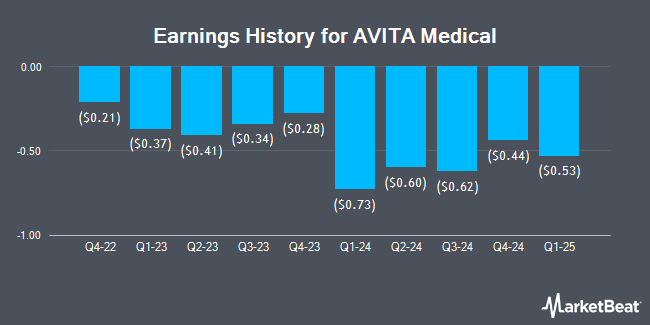

Avita Medical (NASDAQ:RCEL - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The company reported ($0.53) earnings per share for the quarter, missing analysts' consensus estimates of ($0.39) by ($0.14). Avita Medical had a negative net margin of 79.61% and a negative return on equity of 632.62%. The company had revenue of $18.51 million for the quarter, compared to analysts' expectations of $33.15 million. On average, analysts expect Avita Medical to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Avita Medical Price Performance

NASDAQ RCEL traded up $0.13 during trading hours on Monday, reaching $5.29. The company's stock had a trading volume of 93,545 shares, compared to its average volume of 255,062. Avita Medical has a 1 year low of $4.71 and a 1 year high of $14.16. The company has a quick ratio of 1.72, a current ratio of 2.09 and a debt-to-equity ratio of 9.39. The company has a market capitalization of $139.71 million, a price-to-earnings ratio of -2.41 and a beta of 1.63. The firm's 50-day moving average price is $5.59 and its 200-day moving average price is $7.65.

Institutional Investors Weigh In On Avita Medical

Several hedge funds have recently made changes to their positions in the company. Jane Street Group LLC lifted its holdings in shares of Avita Medical by 20.4% in the 1st quarter. Jane Street Group LLC now owns 63,744 shares of the company's stock worth $519,000 after buying an additional 10,789 shares during the period. Strs Ohio purchased a new stake in shares of Avita Medical in the 1st quarter worth $116,000. Jacobs Levy Equity Management Inc. purchased a new stake in shares of Avita Medical in the 1st quarter worth $374,000. Finally, AQR Capital Management LLC purchased a new stake in shares of Avita Medical in the 1st quarter worth $799,000. 27.66% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Separately, D. Boral Capital reaffirmed a "buy" rating and issued a $19.00 price objective on shares of Avita Medical in a research note on Friday, June 6th.

View Our Latest Stock Analysis on RCEL

About Avita Medical

(

Get Free Report)

AVITA Medical, Inc, together with its subsidiaries, operates as a regenerative medicine company in the United States and internationally. The company's lead product is the RECELL System, a cell harvesting device used for the treatment of thermal burn wounds, full-thickness skin defects, and repigmentation of stable depigmented vitiligo lesions.

Featured Articles

Before you consider Avita Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avita Medical wasn't on the list.

While Avita Medical currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.