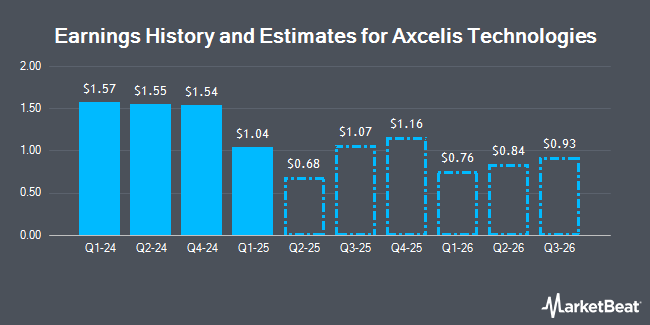

Axcelis Technologies (NASDAQ:ACLS - Get Free Report) updated its third quarter 2025 earnings guidance on Tuesday. The company provided earnings per share guidance of 1.000-1.000 for the period, compared to the consensus earnings per share estimate of 0.739. The company issued revenue guidance of $200.0 million-$200.0 million, compared to the consensus revenue estimate of $186.8 million.

Wall Street Analyst Weigh In

A number of analysts have issued reports on the company. DA Davidson lifted their price target on Axcelis Technologies from $75.00 to $90.00 and gave the stock a "buy" rating in a report on Wednesday. B. Riley lifted their target price on Axcelis Technologies from $58.00 to $75.00 and gave the stock a "neutral" rating in a research report on Wednesday, June 18th. Four equities research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $90.00.

Read Our Latest Research Report on ACLS

Axcelis Technologies Stock Performance

Shares of ACLS traded down $0.09 during midday trading on Friday, reaching $79.42. 389,989 shares of the stock were exchanged, compared to its average volume of 564,253. The business's 50-day moving average price is $70.49 and its 200 day moving average price is $61.48. The company has a debt-to-equity ratio of 0.04, a current ratio of 6.01 and a quick ratio of 4.08. Axcelis Technologies has a twelve month low of $40.40 and a twelve month high of $117.57. The company has a market capitalization of $2.50 billion, a price-to-earnings ratio of 16.24 and a beta of 1.58.

Axcelis Technologies (NASDAQ:ACLS - Get Free Report) last posted its earnings results on Tuesday, August 5th. The semiconductor company reported $1.13 EPS for the quarter, topping analysts' consensus estimates of $0.73 by $0.40. Axcelis Technologies had a return on equity of 16.26% and a net margin of 17.69%. The business had revenue of $194.54 million for the quarter, compared to analysts' expectations of $185.15 million. During the same quarter in the previous year, the firm earned $1.55 earnings per share. The business's revenue was down 24.2% compared to the same quarter last year. On average, sell-side analysts expect that Axcelis Technologies will post 2.55 EPS for the current fiscal year.

Insider Transactions at Axcelis Technologies

In related news, Director John T. Kurtzweil sold 1,682 shares of the business's stock in a transaction dated Tuesday, May 20th. The stock was sold at an average price of $61.93, for a total value of $104,166.26. Following the transaction, the director owned 35,050 shares in the company, valued at $2,170,646.50. The trade was a 4.58% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at the SEC website. 0.48% of the stock is owned by company insiders.

Hedge Funds Weigh In On Axcelis Technologies

Several institutional investors have recently added to or reduced their stakes in the stock. Goldman Sachs Group Inc. increased its position in Axcelis Technologies by 7.5% in the 1st quarter. Goldman Sachs Group Inc. now owns 635,393 shares of the semiconductor company's stock valued at $31,560,000 after acquiring an additional 44,275 shares during the period. Royal Bank of Canada increased its position in Axcelis Technologies by 3.8% in the 1st quarter. Royal Bank of Canada now owns 117,566 shares of the semiconductor company's stock valued at $5,838,000 after acquiring an additional 4,324 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its position in Axcelis Technologies by 1.1% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 78,756 shares of the semiconductor company's stock valued at $3,912,000 after acquiring an additional 836 shares during the period. AQR Capital Management LLC increased its position in Axcelis Technologies by 4.9% in the 1st quarter. AQR Capital Management LLC now owns 35,717 shares of the semiconductor company's stock valued at $1,774,000 after acquiring an additional 1,678 shares during the period. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in Axcelis Technologies by 4.6% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 19,396 shares of the semiconductor company's stock worth $963,000 after purchasing an additional 849 shares during the period. Institutional investors and hedge funds own 89.98% of the company's stock.

About Axcelis Technologies

(

Get Free Report)

Axcelis Technologies, Inc designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia Pacific. The company offers high energy, high current, and medium current implanters for various application requirements.

Featured Articles

Before you consider Axcelis Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axcelis Technologies wasn't on the list.

While Axcelis Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.