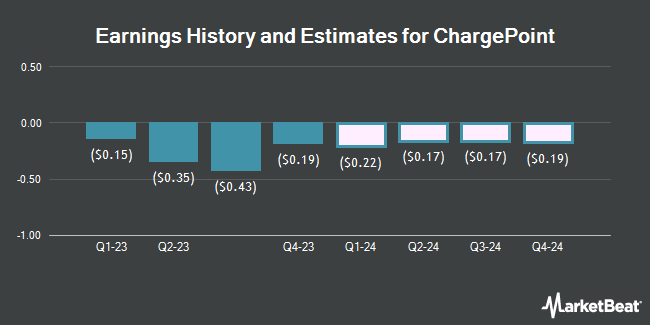

ChargePoint Holdings, Inc. (NYSE:CHPT - Free Report) - Stock analysts at B. Riley dropped their Q1 2027 earnings per share estimates for ChargePoint in a research report issued on Wednesday, July 30th. B. Riley analyst R. Pfingst now anticipates that the company will post earnings per share of ($2.01) for the quarter, down from their previous forecast of ($2.00). The consensus estimate for ChargePoint's current full-year earnings is ($0.57) per share. B. Riley also issued estimates for ChargePoint's Q2 2027 earnings at ($2.01) EPS, Q3 2027 earnings at ($1.81) EPS and Q4 2027 earnings at ($1.61) EPS.

Several other equities research analysts have also recently weighed in on the stock. TD Cowen upgraded shares of ChargePoint to a "hold" rating in a research report on Monday, July 7th. Needham & Company LLC restated a "hold" rating on shares of ChargePoint in a research report on Thursday, June 5th. UBS Group reduced their price objective on ChargePoint from $14.00 to $13.00 and set a "neutral" rating on the stock in a report on Thursday, April 17th. Royal Bank Of Canada restated a "sector perform" rating and set a $20.00 target price on shares of ChargePoint in a research report on Thursday, June 5th. Finally, The Goldman Sachs Group decreased their price target on ChargePoint from $15.00 to $10.00 and set a "sell" rating on the stock in a report on Thursday, April 10th. Two analysts have rated the stock with a sell rating, seven have issued a hold rating, one has issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average price target of $27.88.

Read Our Latest Report on CHPT

ChargePoint Price Performance

Shares of NYSE:CHPT traded up $0.52 during midday trading on Monday, reaching $10.47. The company's stock had a trading volume of 400,161 shares, compared to its average volume of 1,035,090. The business's fifty day simple moving average is $13.29 and its 200-day simple moving average is $13.88. The company has a market capitalization of $239.75 million, a P/E ratio of -0.87 and a beta of 2.23. The company has a debt-to-equity ratio of 2.60, a current ratio of 1.82 and a quick ratio of 1.12. ChargePoint has a fifty-two week low of $8.55 and a fifty-two week high of $40.00.

ChargePoint (NYSE:CHPT - Get Free Report) last released its quarterly earnings results on Wednesday, June 4th. The company reported ($2.00) EPS for the quarter, missing analysts' consensus estimates of ($1.00) by ($1.00). ChargePoint had a negative net margin of 65.79% and a negative return on equity of 131.65%. The firm had revenue of $97.64 million during the quarter, compared to analyst estimates of $100.43 million. During the same quarter last year, the firm earned ($2.20) earnings per share.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the company. IQ EQ FUND MANAGEMENT IRELAND Ltd acquired a new stake in ChargePoint in the second quarter worth $98,000. Y Intercept Hong Kong Ltd bought a new stake in shares of ChargePoint in the 2nd quarter valued at $195,000. Ethic Inc. acquired a new stake in ChargePoint during the 2nd quarter worth $32,000. International Assets Investment Management LLC bought a new position in ChargePoint during the second quarter worth about $27,000. Finally, Trueblood Wealth Management LLC raised its holdings in ChargePoint by 100.0% during the 2nd quarter. Trueblood Wealth Management LLC now owns 40,000 shares of the company's stock worth $28,000 after buying an additional 20,000 shares during the period. Institutional investors own 37.77% of the company's stock.

ChargePoint Company Profile

(

Get Free Report)

ChargePoint Holdings, Inc, together with its subsidiaries, provides electric vehicle (EV) charging networks and charging solutions in the North America and Europe. The company serves commercial, such as retail, workplace, hospitality, parking, recreation, municipal, education, and highway fast charge; fleet, which include delivery, take home, logistics, motor pool, transit, and shared mobility; and residential including single family homes and multi-family apartments and condominiums customers.

Featured Articles

Before you consider ChargePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ChargePoint wasn't on the list.

While ChargePoint currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.