Banco Santander Brasil (NYSE:BSBR - Get Free Report)'s stock had its "hold (c)" rating reaffirmed by research analysts at Weiss Ratings in a research report issued on Wednesday,Weiss Ratings reports.

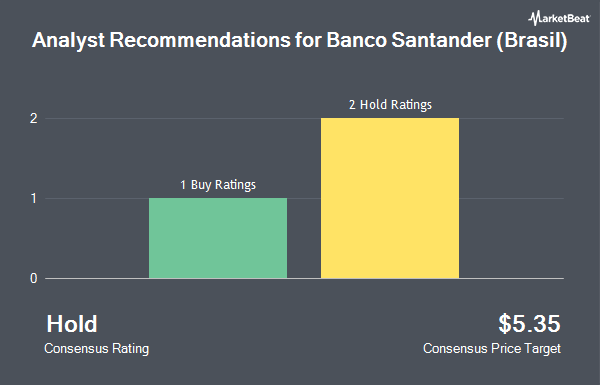

BSBR has been the topic of a number of other research reports. UBS Group upgraded shares of Banco Santander Brasil from a "neutral" rating to a "buy" rating in a report on Wednesday, June 11th. Wall Street Zen upgraded shares of Banco Santander Brasil from a "hold" rating to a "buy" rating in a report on Saturday, September 13th. Two equities research analysts have rated the stock with a Buy rating and three have given a Hold rating to the company. According to data from MarketBeat, Banco Santander Brasil has an average rating of "Hold" and a consensus target price of $5.35.

Get Our Latest Research Report on Banco Santander Brasil

Banco Santander Brasil Stock Down 0.2%

BSBR stock traded down $0.01 during midday trading on Wednesday, reaching $5.25. The company had a trading volume of 364,976 shares, compared to its average volume of 635,006. Banco Santander Brasil has a 1 year low of $3.75 and a 1 year high of $5.65. The company has a current ratio of 1.37, a quick ratio of 1.37 and a debt-to-equity ratio of 3.28. The company has a market capitalization of $19.58 billion, a P/E ratio of 6.48, a PEG ratio of 0.67 and a beta of 0.80. The company has a 50 day moving average of $5.20 and a two-hundred day moving average of $5.11.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the stock. Hantz Financial Services Inc. increased its holdings in shares of Banco Santander Brasil by 553.9% during the 2nd quarter. Hantz Financial Services Inc. now owns 6,997 shares of the bank's stock worth $38,000 after purchasing an additional 5,927 shares during the period. Signaturefd LLC increased its holdings in shares of Banco Santander Brasil by 25.2% during the 1st quarter. Signaturefd LLC now owns 9,872 shares of the bank's stock worth $46,000 after purchasing an additional 1,986 shares during the period. Cubist Systematic Strategies LLC bought a new position in shares of Banco Santander Brasil during the 1st quarter worth about $46,000. Vident Advisory LLC bought a new position in shares of Banco Santander Brasil during the 1st quarter worth about $50,000. Finally, Drive Wealth Management LLC bought a new position in shares of Banco Santander Brasil during the 1st quarter worth about $62,000. Institutional investors own 14.53% of the company's stock.

About Banco Santander Brasil

(

Get Free Report)

Banco Santander (Brasil) SA, together with its subsidiaries, provides various banking products and services to individuals, small and medium enterprises, and corporate customers in Brazil and internationally. The company operates through Commercial Banking and Global Wholesale Banking segments. It offers local loans, commercial financing options, development bank funds, and cash management services; export and import financing, guarantees, structuring of asset services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Banco Santander Brasil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Santander Brasil wasn't on the list.

While Banco Santander Brasil currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.