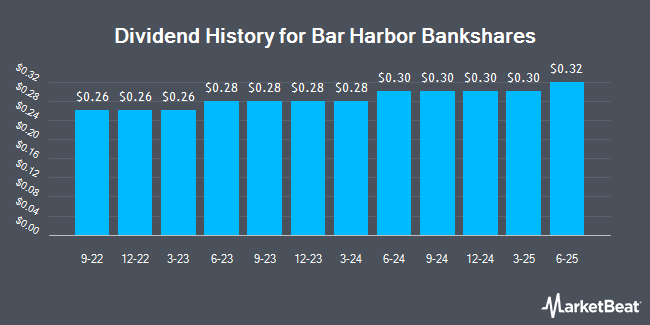

Bar Harbor Bankshares, Inc. (NYSEAMERICAN:BHB - Get Free Report) announced a quarterly dividend on Tuesday, October 21st. Stockholders of record on Thursday, November 20th will be paid a dividend of 0.32 per share by the financial services provider on Friday, December 19th. This represents a c) dividend on an annualized basis and a dividend yield of 4.3%. The ex-dividend date is Thursday, November 20th.

Bar Harbor Bankshares has a payout ratio of 39.4% indicating that its dividend is sufficiently covered by earnings. Analysts expect Bar Harbor Bankshares to earn $2.96 per share next year, which means the company should continue to be able to cover its $1.28 annual dividend with an expected future payout ratio of 43.2%.

Bar Harbor Bankshares Trading Up 1.8%

Shares of BHB stock traded up $0.54 on Wednesday, hitting $30.05. 19,528 shares of the stock traded hands, compared to its average volume of 45,731. The firm's 50-day moving average price is $31.05 and its two-hundred day moving average price is $30.24. The company has a debt-to-equity ratio of 0.63, a quick ratio of 0.98 and a current ratio of 0.98. The stock has a market capitalization of $501.23 million, a PE ratio of 11.65 and a beta of 0.71. Bar Harbor Bankshares has a twelve month low of $26.43 and a twelve month high of $38.47.

Institutional Trading of Bar Harbor Bankshares

A hedge fund recently raised its stake in Bar Harbor Bankshares stock. Trust Co. of Vermont raised its holdings in Bar Harbor Bankshares, Inc. (NYSEAMERICAN:BHB - Free Report) by 10.9% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 43,726 shares of the financial services provider's stock after purchasing an additional 4,282 shares during the quarter. Trust Co. of Vermont owned about 0.29% of Bar Harbor Bankshares worth $1,290,000 as of its most recent filing with the SEC. 54.49% of the stock is owned by institutional investors.

About Bar Harbor Bankshares

(

Get Free Report)

Bar Harbor Bankshares operates as the holding company for Bar Harbor Bank & Trust that provides banking and nonbanking products and services primarily to consumers and businesses. It accepts various deposit products, including interest-bearing and non-interest-bearing demand accounts, savings accounts, time deposits, and money market deposit accounts, as well as certificates of deposit.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bar Harbor Bankshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bar Harbor Bankshares wasn't on the list.

While Bar Harbor Bankshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.