Tandem Diabetes Care (NASDAQ:TNDM - Get Free Report) had its price objective dropped by analysts at Barclays from $53.00 to $51.00 in a report released on Friday,Benzinga reports. The brokerage currently has an "overweight" rating on the medical device company's stock. Barclays's target price would indicate a potential upside of 352.73% from the company's previous close.

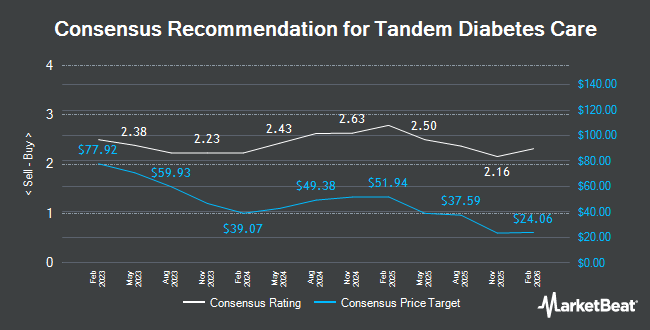

Other research analysts also recently issued research reports about the stock. Stifel Nicolaus reduced their price target on shares of Tandem Diabetes Care from $60.00 to $31.00 and set a "buy" rating for the company in a research report on Thursday, May 1st. Wall Street Zen cut Tandem Diabetes Care from a "hold" rating to a "sell" rating in a research report on Saturday, June 21st. Mizuho began coverage on Tandem Diabetes Care in a research note on Thursday, April 10th. They set a "neutral" rating and a $20.00 price objective on the stock. Truist Financial initiated coverage on Tandem Diabetes Care in a research note on Monday, June 16th. They issued a "hold" rating and a $24.00 target price for the company. Finally, Robert W. Baird cut their target price on Tandem Diabetes Care from $33.00 to $24.00 and set a "neutral" rating for the company in a research report on Thursday, May 1st. Two investment analysts have rated the stock with a sell rating, nine have assigned a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $25.67.

Read Our Latest Stock Report on Tandem Diabetes Care

Tandem Diabetes Care Stock Down 2.2%

Shares of TNDM traded down $0.26 during trading hours on Friday, hitting $11.27. The stock had a trading volume of 1,328,673 shares, compared to its average volume of 1,659,863. Tandem Diabetes Care has a 1-year low of $9.98 and a 1-year high of $47.60. The firm has a market capitalization of $750.33 million, a P/E ratio of -3.67 and a beta of 1.46. The company has a debt-to-equity ratio of 1.99, a current ratio of 2.30 and a quick ratio of 1.81. The firm has a 50 day simple moving average of $17.73 and a 200-day simple moving average of $21.72.

Tandem Diabetes Care (NASDAQ:TNDM - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The medical device company reported ($0.48) earnings per share for the quarter, missing the consensus estimate of ($0.40) by ($0.08). Tandem Diabetes Care had a negative return on equity of 59.02% and a negative net margin of 20.51%. The company had revenue of $240.68 million during the quarter, compared to analysts' expectations of $238.39 million. During the same quarter in the previous year, the company earned ($0.47) EPS. The business's quarterly revenue was up 8.5% on a year-over-year basis. Sell-side analysts predict that Tandem Diabetes Care will post -1.68 EPS for the current fiscal year.

Institutional Investors Weigh In On Tandem Diabetes Care

Institutional investors and hedge funds have recently made changes to their positions in the company. LPL Financial LLC increased its stake in shares of Tandem Diabetes Care by 33.7% during the fourth quarter. LPL Financial LLC now owns 48,036 shares of the medical device company's stock valued at $1,730,000 after acquiring an additional 12,099 shares during the period. JPMorgan Chase & Co. lifted its position in shares of Tandem Diabetes Care by 98.7% in the 4th quarter. JPMorgan Chase & Co. now owns 392,586 shares of the medical device company's stock valued at $14,141,000 after acquiring an additional 195,003 shares in the last quarter. Geode Capital Management LLC grew its position in Tandem Diabetes Care by 0.5% during the fourth quarter. Geode Capital Management LLC now owns 1,533,828 shares of the medical device company's stock valued at $55,261,000 after purchasing an additional 8,012 shares in the last quarter. Wells Fargo & Company MN lifted its position in Tandem Diabetes Care by 35.8% in the fourth quarter. Wells Fargo & Company MN now owns 61,255 shares of the medical device company's stock worth $2,206,000 after purchasing an additional 16,163 shares during the period. Finally, Russell Investments Group Ltd. grew its holdings in Tandem Diabetes Care by 36.5% during the 4th quarter. Russell Investments Group Ltd. now owns 290,228 shares of the medical device company's stock worth $10,454,000 after acquiring an additional 77,594 shares during the last quarter.

About Tandem Diabetes Care

(

Get Free Report)

Tandem Diabetes Care, Inc, a medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally. The company's flagship product is the t:slim X2 insulin delivery system, a pump platform for managing insulin delivery and display continuous glucose monitoring sensor information directly on the pump home screen; and Tandem Mobi insulin pump, an automated insulin delivery system.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tandem Diabetes Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tandem Diabetes Care wasn't on the list.

While Tandem Diabetes Care currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.