Synovus Financial (NYSE:SNV - Get Free Report) had its price target dropped by investment analysts at Barclays from $70.00 to $65.00 in a note issued to investors on Monday,Benzinga reports. The firm presently has an "overweight" rating on the bank's stock. Barclays's price objective would indicate a potential upside of 31.61% from the company's current price.

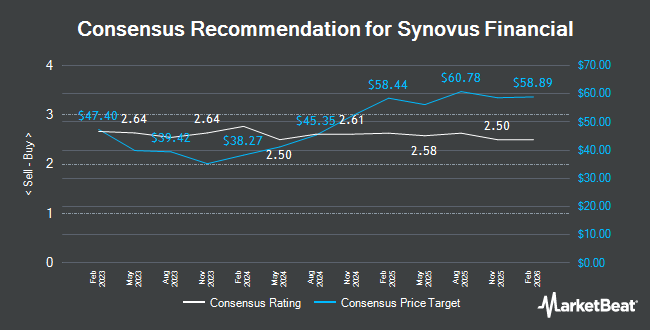

A number of other research firms have also commented on SNV. Jefferies Financial Group initiated coverage on shares of Synovus Financial in a research report on Wednesday, May 21st. They issued a "hold" rating and a $55.00 price objective for the company. Keefe, Bruyette & Woods upgraded shares of Synovus Financial from a "market perform" rating to an "outperform" rating and lifted their price target for the company from $58.00 to $65.00 in a report on Friday, July 18th. Wells Fargo & Company cut shares of Synovus Financial from a "strong-buy" rating to a "hold" rating and dropped their target price for the company from $62.00 to $58.00 in a report on Friday. Stephens dropped their price target on shares of Synovus Financial from $52.00 to $46.00 and set an "equal weight" rating on the stock in a research note on Monday, April 21st. Finally, Wall Street Zen raised Synovus Financial from a "hold" rating to a "buy" rating in a research report on Saturday. Six equities research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the stock. Based on data from MarketBeat.com, Synovus Financial presently has an average rating of "Moderate Buy" and an average target price of $60.33.

Get Our Latest Analysis on Synovus Financial

Synovus Financial Stock Performance

SNV traded down $0.22 during trading on Monday, hitting $49.39. 817,358 shares of the company traded hands, compared to its average volume of 1,543,466. The firm has a market cap of $6.87 billion, a P/E ratio of 9.48, a price-to-earnings-growth ratio of 0.84 and a beta of 1.19. The stock's fifty day moving average is $50.97 and its 200 day moving average is $49.33. The company has a quick ratio of 0.92, a current ratio of 0.92 and a debt-to-equity ratio of 0.77. Synovus Financial has a one year low of $35.94 and a one year high of $61.06.

Synovus Financial (NYSE:SNV - Get Free Report) last posted its quarterly earnings results on Wednesday, July 16th. The bank reported $1.48 earnings per share for the quarter, beating the consensus estimate of $1.25 by $0.23. The company had revenue of $592.08 million during the quarter, compared to analyst estimates of $584.89 million. Synovus Financial had a net margin of 21.52% and a return on equity of 16.20%. During the same quarter in the prior year, the business earned $1.16 earnings per share. As a group, equities analysts predict that Synovus Financial will post 4.89 EPS for the current fiscal year.

Hedge Funds Weigh In On Synovus Financial

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Sei Investments Co. lifted its stake in shares of Synovus Financial by 38.0% in the 4th quarter. Sei Investments Co. now owns 82,887 shares of the bank's stock valued at $4,246,000 after purchasing an additional 22,828 shares during the last quarter. JPMorgan Chase & Co. lifted its stake in shares of Synovus Financial by 20.1% in the 4th quarter. JPMorgan Chase & Co. now owns 435,543 shares of the bank's stock valued at $22,313,000 after purchasing an additional 72,745 shares during the last quarter. Blair William & Co. IL lifted its stake in shares of Synovus Financial by 6.4% in the 4th quarter. Blair William & Co. IL now owns 6,241 shares of the bank's stock valued at $320,000 after purchasing an additional 374 shares during the last quarter. Norges Bank acquired a new position in shares of Synovus Financial in the 4th quarter valued at $77,209,000. Finally, Pictet Asset Management Holding SA lifted its stake in shares of Synovus Financial by 16.6% in the 4th quarter. Pictet Asset Management Holding SA now owns 22,032 shares of the bank's stock valued at $1,129,000 after purchasing an additional 3,142 shares during the last quarter. Institutional investors and hedge funds own 83.85% of the company's stock.

Synovus Financial Company Profile

(

Get Free Report)

Synovus Financial Corp. operates as the bank holding company for Synovus Bank that provides commercial and consumer banking products and services. It operates through four segments: Community Banking, Wholesale Banking, Consumer Banking, and Financial Management Services. The company's commercial banking services include treasury and asset management, capital market, and institutional trust services, as well as commercial, financial, and real estate lending services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Synovus Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synovus Financial wasn't on the list.

While Synovus Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.