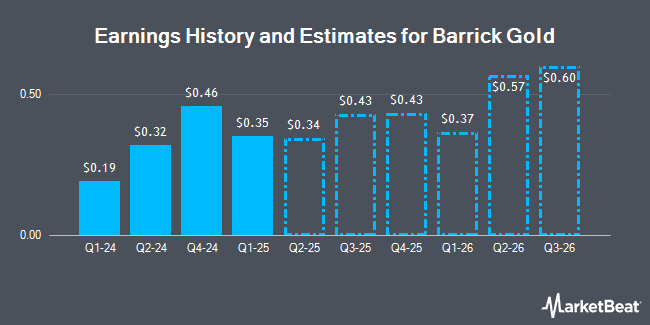

Barrick Mining Corporation (NYSE:B - Free Report) TSE: ABX - Analysts at Raymond James Financial boosted their Q3 2025 earnings per share (EPS) estimates for Barrick Mining in a report issued on Wednesday, August 20th. Raymond James Financial analyst B. Macarthur now anticipates that the gold and copper producer will post earnings of $0.60 per share for the quarter, up from their previous forecast of $0.54. The consensus estimate for Barrick Mining's current full-year earnings is $1.47 per share. Raymond James Financial also issued estimates for Barrick Mining's Q1 2026 earnings at $0.63 EPS, Q2 2026 earnings at $0.66 EPS, Q3 2026 earnings at $0.68 EPS and Q4 2026 earnings at $0.70 EPS.

B has been the subject of several other reports. Wall Street Zen lowered Barrick Mining from a "strong-buy" rating to a "buy" rating in a report on Saturday, August 9th. Royal Bank Of Canada set a $26.00 target price on Barrick Mining and gave the company an "outperform" rating in a report on Wednesday, July 2nd. Cibc World Mkts raised Barrick Mining from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 12th. CIBC raised Barrick Mining from a "neutral" rating to an "outperform" rating in a report on Tuesday, August 12th. Finally, Zacks Research lowered Barrick Mining from a "strong-buy" rating to a "hold" rating in a report on Thursday, August 21st. Two equities research analysts have rated the stock with a Strong Buy rating, seven have issued a Buy rating and six have given a Hold rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $24.85.

View Our Latest Stock Report on Barrick Mining

Barrick Mining Stock Up 1.5%

Barrick Mining stock traded up $0.40 during midday trading on Monday, hitting $26.68. The stock had a trading volume of 18,038,493 shares, compared to its average volume of 15,695,603. The company has a current ratio of 3.21, a quick ratio of 2.53 and a debt-to-equity ratio of 0.14. The stock has a market cap of $45.52 billion, a P/E ratio of 16.78, a P/E/G ratio of 0.48 and a beta of 0.27. Barrick Mining has a 12 month low of $15.11 and a 12 month high of $26.83. The business has a fifty day moving average price of $22.49 and a 200 day moving average price of $20.27.

Barrick Mining (NYSE:B - Get Free Report) TSE: ABX last announced its quarterly earnings data on Monday, August 11th. The gold and copper producer reported $0.47 earnings per share for the quarter, meeting the consensus estimate of $0.47. The firm had revenue of $3.72 billion during the quarter, compared to analyst estimates of $3.60 billion. Barrick Mining had a return on equity of 8.19% and a net margin of 19.99%.Barrick Mining's quarterly revenue was up 16.4% on a year-over-year basis. During the same period in the previous year, the company earned $0.32 earnings per share.

Barrick Mining Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 29th will be issued a $0.15 dividend. This represents a $0.60 annualized dividend and a dividend yield of 2.2%. The ex-dividend date of this dividend is Friday, August 29th. Barrick Mining's payout ratio is presently 25.16%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the business. Vermillion Wealth Management Inc. bought a new position in Barrick Mining in the 2nd quarter worth approximately $25,000. Crowley Wealth Management Inc. bought a new position in Barrick Mining in the 2nd quarter worth approximately $26,000. Concord Wealth Partners bought a new position in Barrick Mining in the 2nd quarter worth approximately $26,000. Ameriflex Group Inc. bought a new position in Barrick Mining in the 2nd quarter worth approximately $27,000. Finally, Trifecta Capital Advisors LLC bought a new position in Barrick Mining in the 2nd quarter worth approximately $27,000. 90.82% of the stock is owned by institutional investors and hedge funds.

Barrick Mining Company Profile

(

Get Free Report)

Barrick Gold Corporation is a sector-leading gold and copper producer. Its shares trade on the New York Stock Exchange under the symbol GOLD and on the Toronto Stock Exchange under the symbol ABX.

In January 2019 Barrick merged with Randgold Resources and in July that year it combined its gold mines in Nevada, USA, with those of Newmont Corporation in a joint venture, Nevada Gold Mines, which is majority-owned and operated by Barrick.

See Also

Before you consider Barrick Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barrick Mining wasn't on the list.

While Barrick Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.