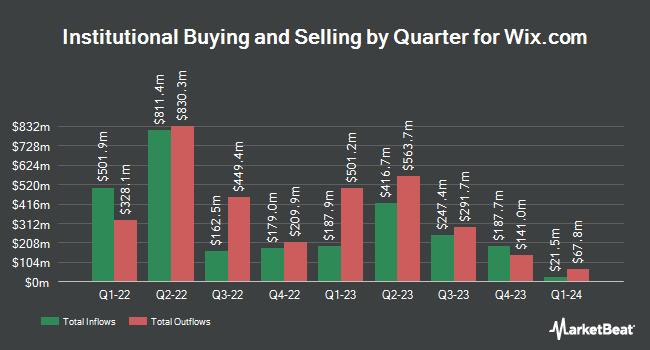

Bayesian Capital Management LP acquired a new stake in Wix.com Ltd. (NASDAQ:WIX - Free Report) in the 4th quarter, according to its most recent filing with the SEC. The fund acquired 7,500 shares of the information services provider's stock, valued at approximately $1,609,000.

A number of other large investors have also bought and sold shares of the business. Newbridge Financial Services Group Inc. bought a new stake in shares of Wix.com during the fourth quarter worth $43,000. Avior Wealth Management LLC increased its holdings in Wix.com by 79.5% during the 4th quarter. Avior Wealth Management LLC now owns 201 shares of the information services provider's stock worth $43,000 after purchasing an additional 89 shares in the last quarter. Global Retirement Partners LLC raised its stake in shares of Wix.com by 36.0% in the 4th quarter. Global Retirement Partners LLC now owns 219 shares of the information services provider's stock valued at $47,000 after purchasing an additional 58 shares during the period. SBI Securities Co. Ltd. bought a new stake in shares of Wix.com in the fourth quarter valued at about $52,000. Finally, Blue Trust Inc. boosted its position in shares of Wix.com by 28.3% during the fourth quarter. Blue Trust Inc. now owns 254 shares of the information services provider's stock worth $54,000 after buying an additional 56 shares during the period. 81.52% of the stock is owned by institutional investors.

Wix.com Trading Up 3.4 %

WIX stock traded up $5.74 during trading hours on Thursday, hitting $172.19. 713,803 shares of the stock were exchanged, compared to its average volume of 659,641. The company has a 50-day simple moving average of $166.90 and a two-hundred day simple moving average of $195.86. The firm has a market capitalization of $9.66 billion, a P/E ratio of 73.27, a P/E/G ratio of 2.83 and a beta of 1.56. Wix.com Ltd. has a 12 month low of $120.78 and a 12 month high of $247.11.

Wix.com declared that its Board of Directors has approved a stock buyback program on Thursday, February 27th that allows the company to buyback $200.00 million in outstanding shares. This buyback authorization allows the information services provider to purchase up to 1.8% of its shares through open market purchases. Shares buyback programs are typically a sign that the company's management believes its shares are undervalued.

Analyst Upgrades and Downgrades

WIX has been the topic of several research reports. Piper Sandler boosted their target price on Wix.com from $249.00 to $262.00 and gave the company an "overweight" rating in a research note on Friday, February 21st. Oppenheimer decreased their target price on shares of Wix.com from $250.00 to $220.00 and set an "outperform" rating for the company in a research report on Wednesday, April 30th. JMP Securities reissued a "market outperform" rating and set a $240.00 price target on shares of Wix.com in a research report on Tuesday, February 18th. JPMorgan Chase & Co. decreased their price objective on Wix.com from $205.00 to $189.00 and set a "neutral" rating for the company in a report on Wednesday, February 19th. Finally, Citigroup dropped their target price on Wix.com from $280.00 to $238.00 and set a "buy" rating on the stock in a report on Friday, April 25th. Five equities research analysts have rated the stock with a hold rating, fifteen have issued a buy rating and three have assigned a strong buy rating to the company's stock. According to MarketBeat, Wix.com presently has a consensus rating of "Moderate Buy" and an average target price of $237.74.

Get Our Latest Analysis on Wix.com

About Wix.com

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Featured Articles

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.