Bayesian Capital Management LP acquired a new stake in shares of Hims & Hers Health, Inc. (NYSE:HIMS - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 37,579 shares of the company's stock, valued at approximately $909,000.

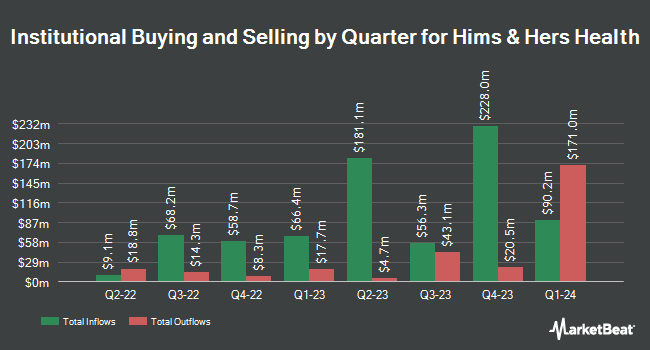

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Barclays PLC grew its position in shares of Hims & Hers Health by 9.7% in the third quarter. Barclays PLC now owns 308,363 shares of the company's stock valued at $5,680,000 after purchasing an additional 27,231 shares in the last quarter. GAMMA Investing LLC grew its holdings in Hims & Hers Health by 2,173.7% during the 4th quarter. GAMMA Investing LLC now owns 2,251 shares of the company's stock valued at $54,000 after buying an additional 2,152 shares in the last quarter. Cadent Capital Advisors LLC increased its position in shares of Hims & Hers Health by 1.5% during the fourth quarter. Cadent Capital Advisors LLC now owns 72,160 shares of the company's stock valued at $1,745,000 after buying an additional 1,060 shares during the period. CHURCHILL MANAGEMENT Corp purchased a new stake in shares of Hims & Hers Health in the fourth quarter worth about $445,000. Finally, Carnegie Investment Counsel boosted its position in shares of Hims & Hers Health by 25.5% in the fourth quarter. Carnegie Investment Counsel now owns 376,910 shares of the company's stock valued at $9,114,000 after acquiring an additional 76,650 shares during the period. Institutional investors own 63.52% of the company's stock.

Hims & Hers Health Price Performance

Hims & Hers Health stock traded up $0.64 during mid-day trading on Friday, hitting $52.04. The company's stock had a trading volume of 61,754,901 shares, compared to its average volume of 18,348,268. The stock has a market cap of $11.65 billion, a price-to-earnings ratio of 118.28 and a beta of 1.84. The business has a 50 day moving average price of $32.97 and a 200-day moving average price of $32.43. Hims & Hers Health, Inc. has a 12 month low of $12.07 and a 12 month high of $72.98.

Hims & Hers Health (NYSE:HIMS - Get Free Report) last announced its quarterly earnings results on Monday, May 5th. The company reported $0.20 EPS for the quarter, topping analysts' consensus estimates of $0.12 by $0.08. Hims & Hers Health had a return on equity of 10.97% and a net margin of 8.19%. The business had revenue of $586.01 million for the quarter, compared to analysts' expectations of $535.21 million. During the same period in the previous year, the firm earned $0.05 EPS. The business's quarterly revenue was up 110.7% on a year-over-year basis. On average, equities research analysts expect that Hims & Hers Health, Inc. will post 0.29 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts have issued reports on the stock. Morgan Stanley lowered their target price on shares of Hims & Hers Health from $60.00 to $40.00 and set an "equal weight" rating on the stock in a research note on Tuesday, April 29th. Needham & Company LLC reiterated a "buy" rating and issued a $61.00 price objective on shares of Hims & Hers Health in a research report on Tuesday. UBS Group restated a "mixed" rating on shares of Hims & Hers Health in a research report on Tuesday. Deutsche Bank Aktiengesellschaft reaffirmed a "hold" rating on shares of Hims & Hers Health in a report on Wednesday. Finally, Canaccord Genuity Group boosted their price objective on Hims & Hers Health from $38.00 to $68.00 and gave the stock a "buy" rating in a report on Wednesday, February 19th. Two research analysts have rated the stock with a sell rating, eight have issued a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $37.67.

Read Our Latest Stock Analysis on Hims & Hers Health

Insider Activity

In related news, CEO Andrew Dudum sold 128,127 shares of Hims & Hers Health stock in a transaction on Tuesday, February 18th. The shares were sold at an average price of $58.27, for a total value of $7,465,960.29. Following the sale, the chief executive officer now owns 97,687 shares in the company, valued at $5,692,221.49. The trade was a 56.74 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Michael Chi sold 7,259 shares of the company's stock in a transaction on Monday, February 10th. The stock was sold at an average price of $43.28, for a total transaction of $314,169.52. Following the completion of the transaction, the insider now owns 193,601 shares of the company's stock, valued at $8,379,051.28. This trade represents a 3.61 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 650,500 shares of company stock valued at $25,790,311. Insiders own 13.71% of the company's stock.

Hims & Hers Health Company Profile

(

Free Report)

Hims & Hers Health, Inc operates a telehealth consultation platform. It connects consumers to healthcare professionals, enabling them to access medical care for mental health, sexual health, dermatology and primary care. The company was founded in 2017 and is headquartered in San Francisco, CA.

Read More

Before you consider Hims & Hers Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hims & Hers Health wasn't on the list.

While Hims & Hers Health currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.