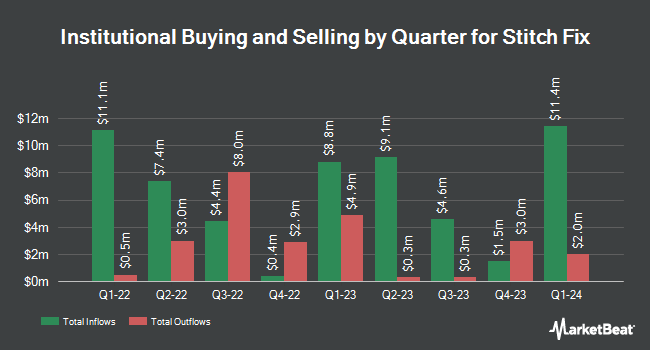

Bayesian Capital Management LP bought a new stake in Stitch Fix, Inc. (NASDAQ:SFIX - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 84,538 shares of the company's stock, valued at approximately $364,000. Bayesian Capital Management LP owned approximately 0.07% of Stitch Fix at the end of the most recent quarter.

Other hedge funds also recently modified their holdings of the company. Barclays PLC lifted its stake in shares of Stitch Fix by 30.7% during the third quarter. Barclays PLC now owns 168,953 shares of the company's stock valued at $475,000 after buying an additional 39,713 shares during the period. Virtu Financial LLC acquired a new position in Stitch Fix in the 3rd quarter valued at $196,000. JPMorgan Chase & Co. lifted its stake in shares of Stitch Fix by 72.7% during the 3rd quarter. JPMorgan Chase & Co. now owns 161,225 shares of the company's stock worth $455,000 after purchasing an additional 67,892 shares during the period. Pallas Capital Advisors LLC purchased a new position in shares of Stitch Fix during the 4th quarter worth $46,000. Finally, Savant Capital LLC acquired a new stake in shares of Stitch Fix during the fourth quarter worth $79,000. 71.04% of the stock is owned by institutional investors and hedge funds.

Stitch Fix Stock Up 16.8%

Shares of NASDAQ SFIX traded up $0.59 during trading on Monday, hitting $4.08. 2,119,042 shares of the company traded hands, compared to its average volume of 2,474,992. The firm has a market capitalization of $524.85 million, a P/E ratio of -4.92 and a beta of 2.00. The company has a 50-day moving average price of $3.39 and a 200-day moving average price of $4.09. Stitch Fix, Inc. has a 1 year low of $2.11 and a 1 year high of $6.99.

Stitch Fix (NASDAQ:SFIX - Get Free Report) last issued its earnings results on Tuesday, March 11th. The company reported ($0.05) earnings per share for the quarter, beating analysts' consensus estimates of ($0.11) by $0.06. The firm had revenue of $312.11 million for the quarter, compared to analysts' expectations of $298.04 million. Stitch Fix had a negative return on equity of 32.71% and a negative net margin of 7.71%. The firm's revenue for the quarter was down 5.5% compared to the same quarter last year. During the same quarter last year, the firm earned ($0.29) earnings per share. Research analysts predict that Stitch Fix, Inc. will post -0.44 EPS for the current fiscal year.

Insider Activity

In related news, insider Casey O'connor sold 50,000 shares of Stitch Fix stock in a transaction on Monday, April 14th. The shares were sold at an average price of $3.04, for a total transaction of $152,000.00. Following the transaction, the insider now owns 575,755 shares in the company, valued at approximately $1,750,295.20. The trade was a 7.99% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Corporate insiders own 16.95% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Telsey Advisory Group reiterated a "market perform" rating and issued a $6.00 target price on shares of Stitch Fix in a research note on Wednesday, March 12th. One research analyst has rated the stock with a sell rating and five have issued a hold rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $4.50.

Read Our Latest Stock Report on SFIX

About Stitch Fix

(

Free Report)

Stitch Fix, Inc sells a range of apparel, shoes, and accessories for men, women, and kids through its website and mobile application in the United States and the United Kingdom. It offers denim, dresses, blouses, skirts, shoes, jewelry, and handbags under the Stitch Fix brand. The company was formerly known as rack habit inc.

Read More

Before you consider Stitch Fix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stitch Fix wasn't on the list.

While Stitch Fix currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.