Bentley Systems (NASDAQ:BSY - Get Free Report) was downgraded by equities researchers at Wall Street Zen from a "buy" rating to a "hold" rating in a research note issued on Wednesday.

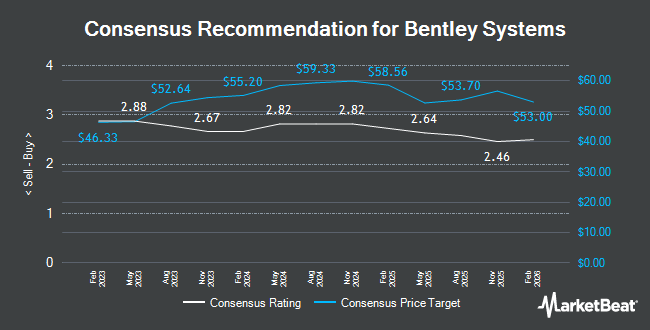

A number of other brokerages have also weighed in on BSY. Royal Bank Of Canada raised their price objective on Bentley Systems from $53.00 to $55.00 and gave the company an "outperform" rating in a research report on Thursday, May 8th. JPMorgan Chase & Co. cut their price objective on Bentley Systems from $52.00 to $45.00 and set a "neutral" rating for the company in a research report on Wednesday, April 9th. Mizuho lowered their price target on shares of Bentley Systems from $60.00 to $50.00 and set an "outperform" rating for the company in a report on Tuesday, April 15th. Oppenheimer increased their price target on shares of Bentley Systems from $49.00 to $50.00 and gave the company an "outperform" rating in a report on Thursday, May 8th. Finally, KeyCorp increased their price target on shares of Bentley Systems from $56.00 to $59.00 and gave the company an "overweight" rating in a report on Monday, July 7th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $53.20.

View Our Latest Stock Analysis on Bentley Systems

Bentley Systems Stock Up 0.4%

BSY stock traded up $0.23 during midday trading on Wednesday, hitting $57.81. The company's stock had a trading volume of 1,437,345 shares, compared to its average volume of 1,273,189. The company has a market cap of $16.87 billion, a PE ratio of 73.18, a P/E/G ratio of 4.68 and a beta of 1.09. Bentley Systems has a 12 month low of $36.51 and a 12 month high of $57.99. The company has a current ratio of 0.49, a quick ratio of 0.49 and a debt-to-equity ratio of 1.13. The firm's 50-day moving average is $51.22 and its 200-day moving average is $46.52.

Bentley Systems (NASDAQ:BSY - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The company reported $0.35 earnings per share for the quarter, beating the consensus estimate of $0.30 by $0.05. The firm had revenue of $370.54 million for the quarter, compared to analysts' expectations of $366.76 million. Bentley Systems had a return on equity of 29.18% and a net margin of 18.46%. The company's revenue was up 9.7% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.31 EPS. On average, equities research analysts forecast that Bentley Systems will post 0.88 earnings per share for the current fiscal year.

Insider Activity

In related news, Director Raymond B. Bentley sold 355,103 shares of the company's stock in a transaction dated Monday, June 16th. The shares were sold at an average price of $49.96, for a total transaction of $17,740,945.88. Following the completion of the transaction, the director owned 15,992,321 shares in the company, valued at $798,976,357.16. This represents a 2.17% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider David R. Shaman sold 19,348 shares of the company's stock in a transaction dated Monday, July 14th. The stock was sold at an average price of $56.96, for a total transaction of $1,102,062.08. Following the transaction, the insider owned 647,609 shares of the company's stock, valued at approximately $36,887,808.64. This trade represents a 2.90% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 1,201,832 shares of company stock worth $61,414,013. 20.56% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Bentley Systems

A number of hedge funds have recently made changes to their positions in the stock. Intech Investment Management LLC raised its stake in Bentley Systems by 3.6% during the 4th quarter. Intech Investment Management LLC now owns 7,283 shares of the company's stock worth $340,000 after acquiring an additional 254 shares in the last quarter. Axxcess Wealth Management LLC raised its stake in Bentley Systems by 3.7% during the 1st quarter. Axxcess Wealth Management LLC now owns 8,471 shares of the company's stock worth $333,000 after acquiring an additional 301 shares in the last quarter. Prentiss Smith & Co. Inc. grew its position in Bentley Systems by 0.5% during the 1st quarter. Prentiss Smith & Co. Inc. now owns 64,171 shares of the company's stock worth $2,524,000 after purchasing an additional 315 shares during the last quarter. Venturi Wealth Management LLC grew its position in Bentley Systems by 3.5% during the 1st quarter. Venturi Wealth Management LLC now owns 9,438 shares of the company's stock worth $371,000 after purchasing an additional 315 shares during the last quarter. Finally, Thrive Wealth Management LLC grew its position in Bentley Systems by 4.1% during the 2nd quarter. Thrive Wealth Management LLC now owns 8,101 shares of the company's stock worth $437,000 after purchasing an additional 316 shares during the last quarter. Hedge funds and other institutional investors own 44.16% of the company's stock.

About Bentley Systems

(

Get Free Report)

Bentley Systems, Incorporated, together with its subsidiaries, provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. The company offers open modeling engineering applications, such as MicroStation, OpenBridge, OpenBuildings, OpenCities, OpenComms, OpenFlows, OpenPlant, OpenRail, OpenRoads, OpenSite, OpenTower, OpenTunnel, OpenUtilities, and OpenWindowPower; and open simulation engineering applications, including ADINA, AutoPIPE, CUBE, DYNAMEQ, EMME, LEGION, Power Line Systems, RAM, SACS, SPIDA, and STAAD; and geoprofessional applications for modeling and simulation of near and deep subsurface conditions, including AGS, Central, GeoStudio, Imago, Leapfrog, MX Deposit, Oasis montaj, OpenGround, and PLAXIS.

Featured Stories

Before you consider Bentley Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bentley Systems wasn't on the list.

While Bentley Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report