Hochschild Mining (LON:HOC - Get Free Report) had its price target increased by investment analysts at Berenberg Bank from GBX 280 to GBX 380 in a research note issued on Tuesday,Digital Look reports. The brokerage presently has a "hold" rating on the stock. Berenberg Bank's price objective would suggest a potential upside of 2.04% from the stock's current price.

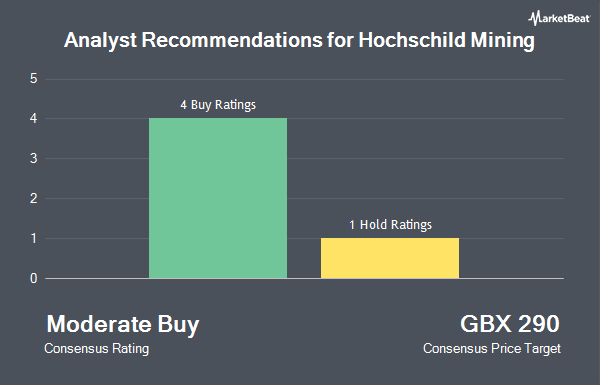

HOC has been the topic of several other reports. JPMorgan Chase & Co. dropped their price objective on shares of Hochschild Mining from GBX 390 to GBX 370 and set an "overweight" rating on the stock in a research note on Thursday, August 28th. Canaccord Genuity Group reissued a "buy" rating and issued a GBX 365 price objective on shares of Hochschild Mining in a research note on Wednesday, August 27th. Peel Hunt reissued a "buy" rating and issued a GBX 340 price objective on shares of Hochschild Mining in a research note on Tuesday. Finally, UBS Group reaffirmed a "buy" rating and set a GBX 300 price target on shares of Hochschild Mining in a research note on Friday, August 15th. Six analysts have rated the stock with a Buy rating and one has given a Hold rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of GBX 333.57.

Get Our Latest Analysis on HOC

Hochschild Mining Stock Performance

Shares of Hochschild Mining stock traded down GBX 5.60 during trading on Tuesday, reaching GBX 372.40. The company's stock had a trading volume of 4,320,429 shares, compared to its average volume of 3,205,811. The company has a 50-day moving average price of GBX 318.42 and a two-hundred day moving average price of GBX 289.13. The firm has a market cap of £1.92 billion, a PE ratio of 1,284.14, a P/E/G ratio of 0.41 and a beta of 1.08. Hochschild Mining has a fifty-two week low of GBX 166 and a fifty-two week high of GBX 393.80. The company has a current ratio of 0.89, a quick ratio of 1.87 and a debt-to-equity ratio of 61.86.

About Hochschild Mining

(

Get Free Report)

We are a leading underground precious metals producer focusing on high grade silver and gold deposits, with over 50 years' operating experience in the Americas.

We currently operate three underground mines, two located in southern Peru and one in southern Argentina. All of our underground operations are epithermal vein mines and the principal mining method used is cut and fill.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Hochschild Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hochschild Mining wasn't on the list.

While Hochschild Mining currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.