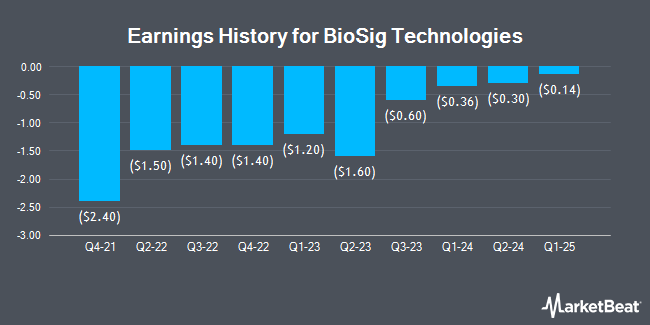

Biosig Technologies (NASDAQ:BSGM - Get Free Report) is expected to issue its quarterly earnings data before the market opens on Wednesday, August 13th. Analysts expect the company to announce earnings of ($0.04) per share for the quarter.

Biosig Technologies (NASDAQ:BSGM - Get Free Report) last posted its quarterly earnings results on Monday, May 19th. The company reported ($0.14) earnings per share for the quarter, missing the consensus estimate of ($0.05) by ($0.09). On average, analysts expect Biosig Technologies to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Biosig Technologies Trading Up 1.9%

BSGM traded up $0.07 during midday trading on Friday, hitting $3.75. The company had a trading volume of 365,051 shares, compared to its average volume of 1,084,771. Biosig Technologies has a 52 week low of $0.23 and a 52 week high of $14.11. The stock's 50 day moving average price is $6.29 and its 200 day moving average price is $3.04.

Analyst Upgrades and Downgrades

Separately, Ascendiant Capital Markets lifted their price target on shares of Biosig Technologies from $2.50 to $10.00 and gave the company a "buy" rating in a research note on Friday, June 6th.

Get Our Latest Stock Analysis on BSGM

Institutional Inflows and Outflows

An institutional investor recently raised its position in Biosig Technologies stock. Geode Capital Management LLC grew its holdings in shares of Biosig Technologies, Inc. (NASDAQ:BSGM - Free Report) by 73.2% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 221,164 shares of the company's stock after buying an additional 93,493 shares during the quarter. Geode Capital Management LLC owned 0.71% of Biosig Technologies worth $1,580,000 at the end of the most recent reporting period. 7.16% of the stock is currently owned by institutional investors and hedge funds.

Biosig Technologies Company Profile

(

Get Free Report)

BioSig Technologies, Inc, together with its subsidiaries, a medical device company, engages in development and commercialization of advanced digital signal processing technology platform for the treatment of cardiovascular arrhythmias in the United States. It offers PURE EP system, a signal processing platform that combines hardware and software to address known challenges associated to signal acquisition that enables electrophysiologists to see signals and analyze in real-time, as well as is designed to address long-standing limitations that slow and disrupt cardiac catheter ablation procedures.

See Also

Before you consider Biosig Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biosig Technologies wasn't on the list.

While Biosig Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.