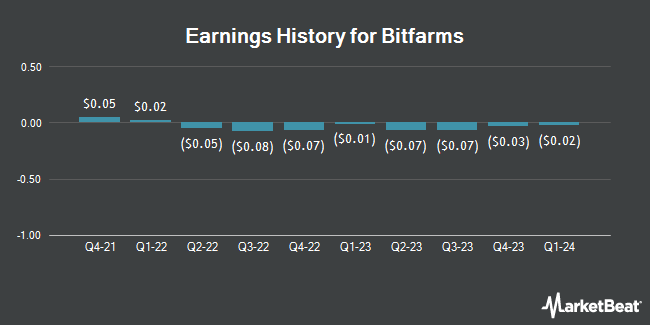

Bitfarms (NASDAQ:BITF - Get Free Report) issued its quarterly earnings results on Tuesday. The company reported ($0.02) earnings per share for the quarter, missing the consensus estimate of ($0.01) by ($0.01), Zacks reports. The business had revenue of $77.80 million during the quarter, compared to analyst estimates of $79.78 million. Bitfarms had a negative net margin of 35.09% and a negative return on equity of 9.86%.

Bitfarms Stock Performance

Shares of NASDAQ BITF traded up $0.10 during midday trading on Monday, reaching $1.36. 28,998,262 shares of the company traded hands, compared to its average volume of 25,811,385. The company has a market cap of $756.04 million, a price-to-earnings ratio of -8.09 and a beta of 3.50. The company has a debt-to-equity ratio of 0.11, a current ratio of 3.11 and a quick ratio of 3.03. The stock has a 50-day moving average price of $1.05 and a 200 day moving average price of $1.06. Bitfarms has a 52 week low of $0.67 and a 52 week high of $2.76.

Hedge Funds Weigh In On Bitfarms

A number of institutional investors and hedge funds have recently added to or reduced their stakes in BITF. Geode Capital Management LLC lifted its position in shares of Bitfarms by 3.8% during the 2nd quarter. Geode Capital Management LLC now owns 3,449,002 shares of the company's stock valued at $2,860,000 after acquiring an additional 125,156 shares during the last quarter. Creative Planning grew its holdings in shares of Bitfarms by 54.0% in the 2nd quarter. Creative Planning now owns 85,580 shares of the company's stock worth $72,000 after acquiring an additional 30,000 shares during the last quarter. Cetera Investment Advisers raised its position in shares of Bitfarms by 1.4% during the second quarter. Cetera Investment Advisers now owns 789,700 shares of the company's stock worth $664,000 after purchasing an additional 10,622 shares during the period. Legal & General Group Plc lifted its holdings in shares of Bitfarms by 4.1% during the second quarter. Legal & General Group Plc now owns 370,869 shares of the company's stock valued at $309,000 after purchasing an additional 14,513 shares during the last quarter. Finally, Invesco Ltd. boosted its position in shares of Bitfarms by 40.4% in the 2nd quarter. Invesco Ltd. now owns 13,234,973 shares of the company's stock valued at $11,120,000 after purchasing an additional 3,806,810 shares during the period. 20.59% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on the company. Jones Trading assumed coverage on Bitfarms in a research report on Monday, July 21st. They set a "buy" rating and a $2.00 price target for the company. Alliance Global Partners reissued a "buy" rating on shares of Bitfarms in a research report on Wednesday, May 14th. Finally, HC Wainwright reissued a "buy" rating on shares of Bitfarms in a research note on Wednesday, May 14th. Five research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus price target of $3.95.

View Our Latest Stock Analysis on BITF

About Bitfarms

(

Get Free Report)

Bitfarms Ltd. engages in the mining of cryptocurrency coins and tokens in Canada, the United States, Paraguay, and Argentina. It owns and operates server farms that primarily validates transactions on the Bitcoin Blockchain and earning cryptocurrency from block rewards and transaction fees. The company also provides electrician services to commercial and residential customers in Quebec, Canada.

Recommended Stories

Before you consider Bitfarms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bitfarms wasn't on the list.

While Bitfarms currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.