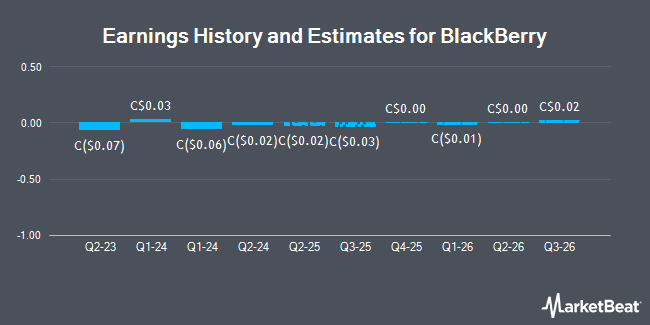

BlackBerry Limited (TSE:BB - Free Report) NASDAQ: BBRY - Analysts at Raymond James Financial decreased their Q3 2026 earnings per share (EPS) estimates for BlackBerry in a research note issued on Wednesday, June 25th. Raymond James Financial analyst S. Li now forecasts that the company will earn $0.02 per share for the quarter, down from their prior estimate of $0.05. The consensus estimate for BlackBerry's current full-year earnings is $0.06 per share.

Separately, Canaccord Genuity Group increased their price target on shares of BlackBerry from C$3.00 to C$4.75 and gave the stock a "hold" rating in a report on Tuesday, March 11th.

Read Our Latest Stock Report on BB

BlackBerry Stock Performance

Shares of TSE:BB traded up C$0.09 on Monday, hitting C$5.84. 2,651,489 shares of the company were exchanged, compared to its average volume of 2,537,838. The firm has a market capitalization of C$2.42 billion, a P/E ratio of -18.81, a price-to-earnings-growth ratio of 0.06 and a beta of 1.07. The company has a current ratio of 1.37, a quick ratio of 1.49 and a debt-to-equity ratio of 30.90. BlackBerry has a 1-year low of C$2.89 and a 1-year high of C$8.86. The stock's 50 day moving average price is C$5.50 and its 200 day moving average price is C$5.78.

Insiders Place Their Bets

In related news, Senior Officer Philip Simon Kurtz sold 16,217 shares of the company's stock in a transaction dated Tuesday, June 24th. The shares were sold at an average price of C$7.20, for a total transaction of C$116,762.40. Insiders own 1.70% of the company's stock.

BlackBerry Company Profile

(

Get Free Report)

BlackBerry Limited provides intelligent security software and services to enterprises and governments worldwide. The company operates through three segments: Cybersecurity, IoT, and Licensing and Other. The company offers CylanceENDPOINT, an integrated endpoint security solution; CylanceGUARD, a managed detection and response solution; CylanceEDGE, an AI-powered continuous authentication zero trust network access solution; CylanceINTELLIGENCE, a contextual cyber threat intelligence service; BlackBerry Dynamics offers a development platform and secure container for mobile applications; BlackBerry Workspaces a secure Enterprise File Sync and Share (EFSS) solution; BlackBerry Messenger (BBM) Enterprise, an enterprise-grade secure instant messaging solution for messaging, voice and video; BlackBerry SecuSUITE is a certified, multi-OS voice and text messaging solution; BlackBerry AtHoc, a secure networked critical event management solution; and BlackBerry unified endpoint management (UEM) solutions.

Read More

Before you consider BlackBerry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackBerry wasn't on the list.

While BlackBerry currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.