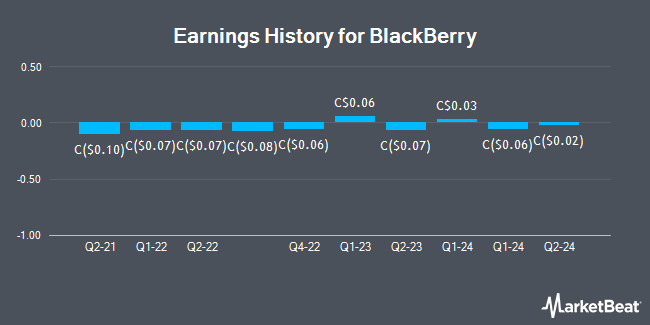

BlackBerry (TSE:BB - Get Free Report) NASDAQ: BBRY announced its quarterly earnings data on Thursday. The company reported C$0.02 EPS for the quarter, beating the consensus estimate of C$0.01 by C$0.01, RTT News reports. BlackBerry had a negative net margin of 21.16% and a negative return on equity of 17.21%.

BlackBerry Trading Up 0.7%

BlackBerry stock opened at C$5.93 on Thursday. The firm's 50 day moving average price is C$5.29 and its 200-day moving average price is C$5.38. BlackBerry has a 1 year low of C$3.07 and a 1 year high of C$8.86. The stock has a market cap of C$3.53 billion, a P/E ratio of -98.83, a PEG ratio of 0.06 and a beta of 0.94. The company has a debt-to-equity ratio of 30.90, a current ratio of 1.37 and a quick ratio of 1.49.

BlackBerry Company Profile

(

Get Free Report)

BlackBerry, once known for being the world's largest smartphone manufacturer, is now exclusively a software provider with a stated goal of end-to-end secure communication for enterprises. The firm provides endpoint management and protection to enterprises, specializing in regulated industries like government, as well as embedded software to the automotive, medical, and industrial markets.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BlackBerry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackBerry wasn't on the list.

While BlackBerry currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.