Alamos Gold (TSE:AGI - Free Report) NYSE: AGI had its price target upped by BMO Capital Markets from C$48.00 to C$51.00 in a research report report published on Tuesday morning,BayStreet.CA reports.

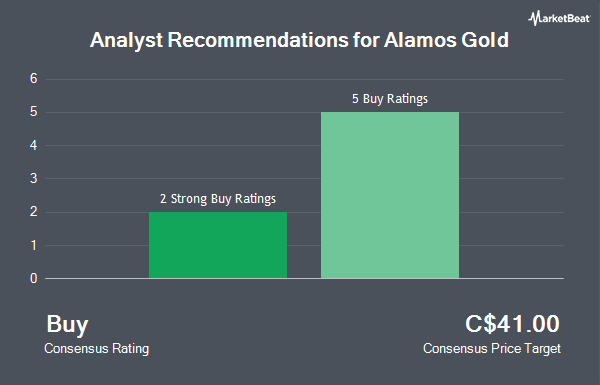

AGI has been the subject of several other reports. Stifel Canada raised shares of Alamos Gold to a "strong-buy" rating in a report on Tuesday, July 8th. TD Securities lowered their price objective on shares of Alamos Gold from C$48.00 to C$47.00 and set a "buy" rating on the stock in a research report on Friday, August 1st. National Bankshares lifted their price target on shares of Alamos Gold from C$51.75 to C$52.25 and gave the stock an "outperform" rating in a research note on Friday, June 27th. Finally, Bank of America raised their price target on Alamos Gold from C$50.50 to C$55.00 in a research report on Friday, August 29th. Two investment analysts have rated the stock with a Strong Buy rating and three have assigned a Buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Buy" and a consensus price target of C$49.54.

Get Our Latest Analysis on Alamos Gold

Alamos Gold Stock Performance

AGI stock traded up C$1.51 during mid-day trading on Tuesday, hitting C$44.49. The company had a trading volume of 4,338,768 shares, compared to its average volume of 1,287,795. The company has a debt-to-equity ratio of 8.48, a quick ratio of 1.06 and a current ratio of 1.62. The firm has a market cap of C$18.70 billion, a PE ratio of 54.26, a price-to-earnings-growth ratio of -2.10 and a beta of 0.59. Alamos Gold has a 12 month low of C$24.47 and a 12 month high of C$46.94. The stock's fifty day moving average price is C$38.81 and its two-hundred day moving average price is C$37.52.

Alamos Gold Cuts Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 15th. Stockholders of record on Thursday, September 11th were issued a dividend of $0.025 per share. This represents a $0.10 dividend on an annualized basis and a dividend yield of 0.2%. Alamos Gold's payout ratio is currently 12.20%.

Alamos Gold Company Profile

(

Get Free Report)

Alamos Gold Inc acquires, explores, and produces gold and other precious metals, and operates in two principal geographic areas: Canada and Mexico. The company has three operating mines in North America: the Young-Davidson Mine in Canada and the Mulatos and El Chanate Mines in Sonora, Mexico. The Young-Davidson mine is the group's largest revenue contributor, and the property also holds mineral leases and claims covering approximately 11,000 acres.

Featured Articles

Before you consider Alamos Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamos Gold wasn't on the list.

While Alamos Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.