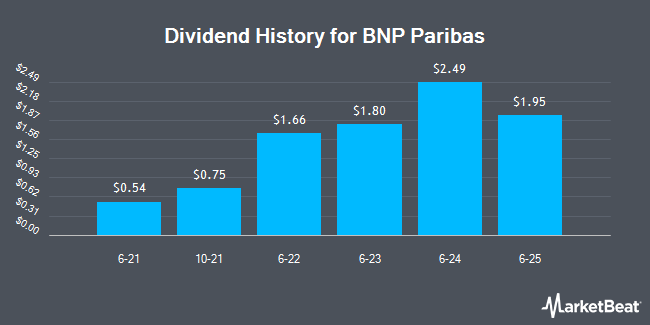

BNP Paribas SA (OTCMKTS:BNPQY - Get Free Report) announced a dividend on Friday, September 19th, investing.com reports. Investors of record on Friday, September 26th will be paid a dividend of 1.2622 per share by the financial services provider on Wednesday, October 29th. This represents a dividend yield of 272.0%. The ex-dividend date is Thursday, September 25th.

BNP Paribas Stock Performance

Shares of BNPQY traded up $0.46 on Tuesday, reaching $47.02. 72,198 shares of the company's stock traded hands, compared to its average volume of 298,211. The company has a current ratio of 0.65, a quick ratio of 0.65 and a debt-to-equity ratio of 1.78. The stock's 50 day simple moving average is $46.22 and its two-hundred day simple moving average is $43.90. BNP Paribas has a 52-week low of $28.93 and a 52-week high of $49.32. The stock has a market cap of $106.27 billion, a PE ratio of 8.82, a PEG ratio of 0.79 and a beta of 1.13.

BNP Paribas (OTCMKTS:BNPQY - Get Free Report) last released its earnings results on Thursday, July 24th. The financial services provider reported $1.64 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.55 by $0.09. BNP Paribas had a return on equity of 8.40% and a net margin of 22.65%.The business had revenue of $14.27 billion during the quarter, compared to the consensus estimate of $12.75 billion. On average, analysts forecast that BNP Paribas will post 5.02 earnings per share for the current fiscal year.

BNP Paribas Company Profile

(

Get Free Report)

BNP Paribas SA provides various banking and financial products and services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. It operates through three divisions: Corporate & Institutional Banking; Commercial, Personal Banking & Services; and Investment & Protection Services.

Featured Stories

Before you consider BNP Paribas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BNP Paribas wasn't on the list.

While BNP Paribas currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.