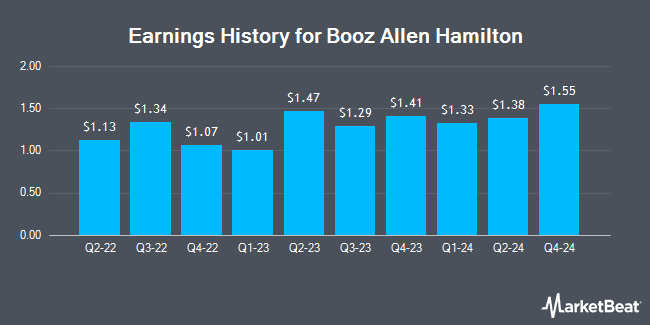

Booz Allen Hamilton (NYSE:BAH - Get Free Report) announced its quarterly earnings data on Friday. The business services provider reported $1.48 earnings per share for the quarter, beating the consensus estimate of $1.45 by $0.03, Zacks reports. Booz Allen Hamilton had a return on equity of 72.35% and a net margin of 7.81%. The business had revenue of $2.92 billion during the quarter, compared to analyst estimates of $2.96 billion. During the same quarter in the prior year, the firm posted $1.38 earnings per share. The company's revenue was down .6% on a year-over-year basis. Booz Allen Hamilton updated its FY 2026 guidance to 6.200-6.550 EPS.

Booz Allen Hamilton Stock Performance

Shares of NYSE BAH traded down $1.99 during mid-day trading on Friday, hitting $113.13. The stock had a trading volume of 4,378,349 shares, compared to its average volume of 1,852,598. The company has a debt-to-equity ratio of 3.90, a quick ratio of 1.79 and a current ratio of 1.79. The company has a 50 day moving average of $107.54 and a two-hundred day moving average of $114.83. Booz Allen Hamilton has a twelve month low of $98.95 and a twelve month high of $190.59. The firm has a market cap of $14.05 billion, a PE ratio of 15.60, a PEG ratio of 1.80 and a beta of 0.48.

Booz Allen Hamilton Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, August 29th. Stockholders of record on Thursday, August 14th will be given a $0.55 dividend. This represents a $2.20 annualized dividend and a dividend yield of 1.94%. Booz Allen Hamilton's payout ratio is presently 30.34%.

Institutional Trading of Booz Allen Hamilton

An institutional investor recently raised its position in Booz Allen Hamilton stock. NewEdge Advisors LLC lifted its holdings in Booz Allen Hamilton Holding Corporation (NYSE:BAH - Free Report) by 365.0% in the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 11,750 shares of the business services provider's stock after purchasing an additional 9,223 shares during the period. NewEdge Advisors LLC's holdings in Booz Allen Hamilton were worth $1,229,000 at the end of the most recent reporting period. Hedge funds and other institutional investors own 91.82% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on the company. Truist Financial dropped their target price on Booz Allen Hamilton from $142.00 to $110.00 and set a "hold" rating for the company in a report on Monday, April 14th. Raymond James Financial reissued a "market perform" rating on shares of Booz Allen Hamilton in a research report on Friday, May 23rd. UBS Group boosted their price objective on Booz Allen Hamilton from $120.00 to $135.00 and gave the stock a "neutral" rating in a report on Monday, May 19th. Wells Fargo & Company lowered their price target on shares of Booz Allen Hamilton from $148.00 to $135.00 and set an "overweight" rating for the company in a report on Friday, May 23rd. Finally, Stifel Nicolaus assumed coverage on shares of Booz Allen Hamilton in a research report on Tuesday, June 24th. They set a "hold" rating and a $112.00 price objective on the stock. Two analysts have rated the stock with a sell rating, seven have given a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $134.64.

Check Out Our Latest Stock Analysis on Booz Allen Hamilton

Booz Allen Hamilton Company Profile

(

Get Free Report)

Booz Allen Hamilton Holding Corporation provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally. It focuses on artificial intelligence services comprising of machine learning, predictive modeling, automation and decision analytics, and quantum computing.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Booz Allen Hamilton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booz Allen Hamilton wasn't on the list.

While Booz Allen Hamilton currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.