Investment analysts at Wells Fargo & Company began coverage on shares of BP (NYSE:BP - Get Free Report) in a research report issued to clients and investors on Friday,Benzinga reports. The firm set an "equal weight" rating and a $37.00 price target on the oil and gas exploration company's stock. Wells Fargo & Company's target price points to a potential upside of 12.87% from the company's current price.

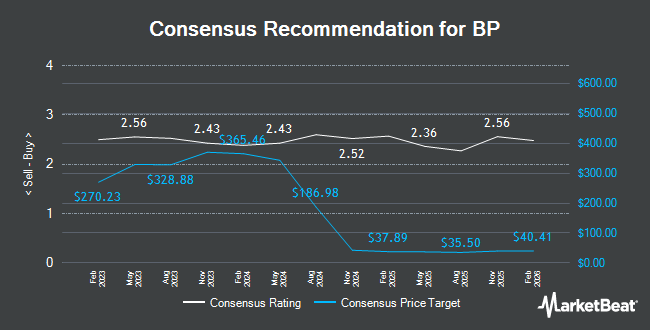

A number of other analysts have also commented on BP. BNP Paribas raised shares of BP from a "neutral" rating to an "outperform" rating in a report on Monday, September 15th. Scotiabank reaffirmed an "outperform" rating on shares of BP in a report on Thursday, October 9th. DZ Bank raised shares of BP from a "hold" rating to a "strong-buy" rating in a report on Wednesday, August 6th. Weiss Ratings reaffirmed a "hold (c-)" rating on shares of BP in a report on Wednesday, October 8th. Finally, Melius Research began coverage on shares of BP in a report on Wednesday, August 20th. They set a "buy" rating and a $66.00 target price for the company. Two equities research analysts have rated the stock with a Strong Buy rating, five have issued a Buy rating, nine have assigned a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $42.59.

View Our Latest Stock Report on BP

BP Price Performance

BP opened at $32.78 on Friday. BP has a one year low of $25.22 and a one year high of $35.88. The company has a debt-to-equity ratio of 0.68, a current ratio of 1.21 and a quick ratio of 0.92. The company's 50 day simple moving average is $34.38 and its 200-day simple moving average is $31.57. The stock has a market capitalization of $86.33 billion, a P/E ratio of 156.10, a price-to-earnings-growth ratio of 1.93 and a beta of 0.54.

BP (NYSE:BP - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The oil and gas exploration company reported $0.90 EPS for the quarter, beating the consensus estimate of $0.68 by $0.22. BP had a net margin of 0.29% and a return on equity of 9.08%. The business had revenue of $46.63 billion for the quarter, compared to analysts' expectations of $42.88 billion. During the same period in the prior year, the firm earned $1.00 earnings per share. BP's revenue was down 1.4% compared to the same quarter last year. Sell-side analysts anticipate that BP will post 3.53 earnings per share for the current fiscal year.

Institutional Investors Weigh In On BP

Institutional investors have recently added to or reduced their stakes in the stock. IHT Wealth Management LLC raised its stake in shares of BP by 3.3% during the second quarter. IHT Wealth Management LLC now owns 12,513 shares of the oil and gas exploration company's stock valued at $375,000 after acquiring an additional 398 shares during the last quarter. Great Lakes Advisors LLC raised its stake in shares of BP by 6.0% during the first quarter. Great Lakes Advisors LLC now owns 8,022 shares of the oil and gas exploration company's stock valued at $271,000 after acquiring an additional 451 shares during the last quarter. Confluence Wealth Services Inc. raised its stake in shares of BP by 5.9% during the first quarter. Confluence Wealth Services Inc. now owns 9,963 shares of the oil and gas exploration company's stock valued at $337,000 after acquiring an additional 551 shares during the last quarter. Gamco Investors INC. ET AL raised its stake in shares of BP by 7.4% during the second quarter. Gamco Investors INC. ET AL now owns 8,295 shares of the oil and gas exploration company's stock valued at $248,000 after acquiring an additional 568 shares during the last quarter. Finally, Stock Yards Bank & Trust Co. raised its stake in shares of BP by 1.6% during the second quarter. Stock Yards Bank & Trust Co. now owns 37,941 shares of the oil and gas exploration company's stock valued at $1,136,000 after acquiring an additional 592 shares during the last quarter. 11.01% of the stock is owned by institutional investors.

About BP

(

Get Free Report)

BP p.l.c. provides carbon products and services. The company operates through Gas & Low Carbon Energy, Oil Production & Operations, and Customers & Products segments. It engages in the production of natural gas, and integrated gas and power; trading of gas; operation of onshore and offshore wind power, as well as hydrogen and carbon capture and storage facilities; trading and marketing of renewable and non-renewable power; and production of crude oil.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider BP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BP wasn't on the list.

While BP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.