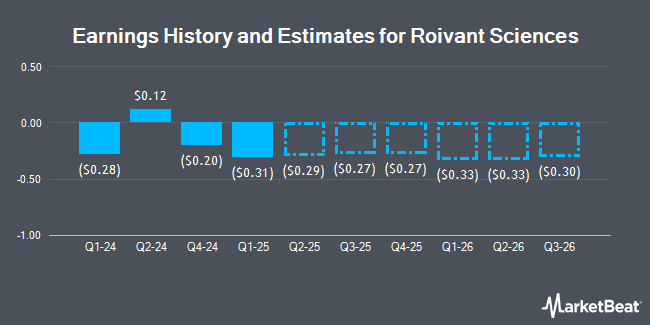

Roivant Sciences Ltd. (NASDAQ:ROIV - Free Report) - Investment analysts at HC Wainwright issued their Q1 2027 EPS estimates for Roivant Sciences in a note issued to investors on Thursday, September 18th. HC Wainwright analyst D. Tsao expects that the company will earn ($0.26) per share for the quarter. HC Wainwright currently has a "Buy" rating and a $20.00 target price on the stock. The consensus estimate for Roivant Sciences' current full-year earnings is ($0.92) per share. HC Wainwright also issued estimates for Roivant Sciences' Q2 2027 earnings at ($0.32) EPS, Q3 2027 earnings at ($0.33) EPS, Q4 2027 earnings at ($0.34) EPS and FY2027 earnings at ($1.25) EPS.

ROIV has been the subject of several other reports. Jefferies Financial Group raised their price objective on shares of Roivant Sciences from $18.00 to $20.00 and gave the stock a "buy" rating in a research report on Thursday. The Goldman Sachs Group raised their price objective on shares of Roivant Sciences from $20.00 to $24.00 and gave the stock a "buy" rating in a research report on Thursday. JPMorgan Chase & Co. raised their price objective on shares of Roivant Sciences from $16.00 to $20.00 and gave the stock an "overweight" rating in a research report on Thursday. Bank of America raised their price objective on shares of Roivant Sciences from $12.00 to $16.50 and gave the stock a "neutral" rating in a research report on Thursday. Finally, Citigroup initiated coverage on shares of Roivant Sciences in a research report on Tuesday, September 2nd. They set a "buy" rating and a $16.00 price objective for the company. One investment analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and a consensus target price of $19.94.

Get Our Latest Research Report on ROIV

Roivant Sciences Stock Down 0.3%

Shares of NASDAQ ROIV opened at $15.04 on Monday. Roivant Sciences has a 52 week low of $8.73 and a 52 week high of $16.05. The stock has a market capitalization of $10.27 billion, a price-to-earnings ratio of -21.49 and a beta of 1.15. The firm has a 50-day simple moving average of $12.22 and a 200-day simple moving average of $11.29.

Insider Activity

In other Roivant Sciences news, CEO Matthew Gline acquired 3,315 shares of the stock in a transaction dated Thursday, September 18th. The stock was acquired at an average price of $15.07 per share, with a total value of $49,957.05. Following the completion of the purchase, the chief executive officer owned 17,287,081 shares in the company, valued at $260,516,310.67. This trade represents a 0.02% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Eric Venker sold 100,000 shares of the firm's stock in a transaction that occurred on Wednesday, August 20th. The shares were sold at an average price of $11.72, for a total transaction of $1,172,000.00. Following the completion of the transaction, the chief executive officer directly owned 1,653,585 shares of the company's stock, valued at approximately $19,380,016.20. The trade was a 5.70% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 1,975,749 shares of company stock valued at $24,780,210. 10.80% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently made changes to their positions in ROIV. Vident Advisory LLC boosted its stake in shares of Roivant Sciences by 98.7% in the fourth quarter. Vident Advisory LLC now owns 32,039 shares of the company's stock valued at $379,000 after purchasing an additional 15,918 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in shares of Roivant Sciences by 4.5% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,411,466 shares of the company's stock valued at $28,528,000 after purchasing an additional 104,288 shares during the period. GF Fund Management CO. LTD. purchased a new position in shares of Roivant Sciences in the fourth quarter valued at approximately $181,000. Jefferies Financial Group Inc. purchased a new position in shares of Roivant Sciences in the fourth quarter valued at approximately $473,000. Finally, Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in Roivant Sciences in the fourth quarter valued at approximately $194,000. Hedge funds and other institutional investors own 64.76% of the company's stock.

Roivant Sciences Company Profile

(

Get Free Report)

Roivant Sciences Ltd., a commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for inflammation and immunology areas. The company provides Vants, a model to develop and commercialize its medicines and technologies focusing on biopharmaceutical businesses, discovery-stage companies, and health technology startups.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Roivant Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roivant Sciences wasn't on the list.

While Roivant Sciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.