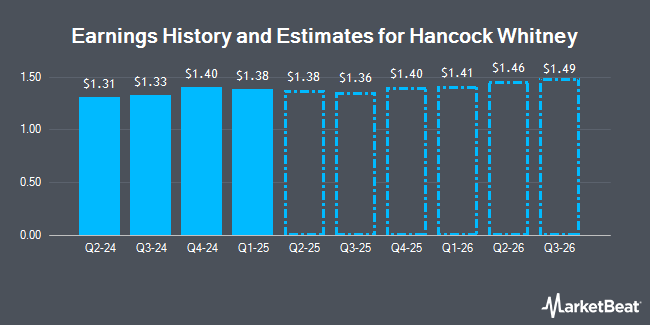

Hancock Whitney Corporation (NASDAQ:HWC - Free Report) - Equities researchers at Zacks Research increased their Q4 2025 earnings per share (EPS) estimates for Hancock Whitney in a research report issued on Wednesday, August 20th. Zacks Research analyst Team now expects that the company will post earnings per share of $1.44 for the quarter, up from their prior forecast of $1.43. The consensus estimate for Hancock Whitney's current full-year earnings is $5.53 per share. Zacks Research also issued estimates for Hancock Whitney's Q1 2026 earnings at $1.41 EPS and FY2026 earnings at $5.72 EPS.

Hancock Whitney (NASDAQ:HWC - Get Free Report) last released its quarterly earnings data on Tuesday, July 15th. The company reported $1.37 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.36 by $0.01. Hancock Whitney had a return on equity of 11.21% and a net margin of 23.28%.The company had revenue of $377.98 million during the quarter, compared to analysts' expectations of $375.99 million. During the same period last year, the firm posted $1.31 earnings per share.

Several other brokerages have also recently weighed in on HWC. Piper Sandler lifted their price objective on Hancock Whitney from $70.00 to $72.00 and gave the company an "overweight" rating in a report on Wednesday, July 16th. Keefe, Bruyette & Woods lowered Hancock Whitney from an "outperform" rating to a "market perform" rating and boosted their price objective for the stock from $62.00 to $63.00 in a research report on Friday, July 11th. Raymond James Financial reiterated a "strong-buy" rating on shares of Hancock Whitney in a research report on Wednesday, July 16th. Citigroup upped their price target on Hancock Whitney from $70.00 to $74.00 and gave the company a "buy" rating in a research report on Tuesday. Finally, Wall Street Zen lowered Hancock Whitney from a "hold" rating to a "sell" rating in a research report on Monday, August 11th. One equities research analyst has rated the stock with a Strong Buy rating, five have issued a Buy rating and two have assigned a Hold rating to the company. Based on data from MarketBeat.com, Hancock Whitney presently has a consensus rating of "Moderate Buy" and an average target price of $67.63.

Read Our Latest Report on HWC

Hancock Whitney Stock Performance

HWC traded up $0.69 during trading on Friday, hitting $64.23. The stock had a trading volume of 114,028 shares, compared to its average volume of 714,246. The company has a 50 day moving average price of $59.45 and a 200-day moving average price of $55.56. The firm has a market cap of $5.44 billion, a price-to-earnings ratio of 11.81 and a beta of 1.11. Hancock Whitney has a one year low of $43.90 and a one year high of $64.20. The company has a debt-to-equity ratio of 0.05, a current ratio of 0.81 and a quick ratio of 0.81.

Institutional Trading of Hancock Whitney

A number of institutional investors and hedge funds have recently modified their holdings of HWC. True Wealth Design LLC increased its position in shares of Hancock Whitney by 929.5% during the second quarter. True Wealth Design LLC now owns 453 shares of the company's stock valued at $26,000 after acquiring an additional 409 shares during the last quarter. Brooklyn Investment Group purchased a new stake in shares of Hancock Whitney during the first quarter valued at approximately $31,000. Versant Capital Management Inc increased its position in shares of Hancock Whitney by 554.6% during the first quarter. Versant Capital Management Inc now owns 707 shares of the company's stock valued at $37,000 after acquiring an additional 599 shares during the last quarter. Virtus Advisers LLC purchased a new stake in shares of Hancock Whitney during the first quarter valued at approximately $41,000. Finally, Hantz Financial Services Inc. increased its position in shares of Hancock Whitney by 6,107.7% during the second quarter. Hantz Financial Services Inc. now owns 807 shares of the company's stock valued at $46,000 after acquiring an additional 794 shares during the last quarter. 81.22% of the stock is owned by hedge funds and other institutional investors.

Hancock Whitney Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, September 5th will be paid a $0.45 dividend. The ex-dividend date of this dividend is Friday, September 5th. This represents a $1.80 annualized dividend and a dividend yield of 2.8%. Hancock Whitney's dividend payout ratio is 33.15%.

Hancock Whitney Company Profile

(

Get Free Report)

Hancock Whitney Corporation operates as the financial holding company for Hancock Whitney Bank that provides traditional and online banking services to commercial, small business, and retail customers. It offers various transaction and savings deposit products consisting of brokered deposits, time deposits, and money market accounts; treasury management services, secured and unsecured loan products including revolving credit facilities, and letters of credit and similar financial guarantees; and trust and investment management services to retirement plans, corporations, and individuals, and investment advisory and brokerage products.

Recommended Stories

Before you consider Hancock Whitney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hancock Whitney wasn't on the list.

While Hancock Whitney currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.