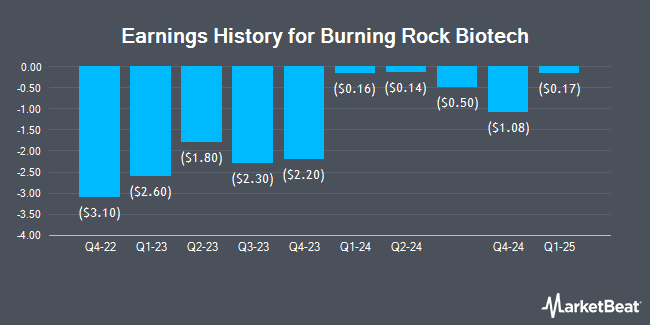

Burning Rock Biotech (NASDAQ:BNR - Get Free Report) released its quarterly earnings data on Monday. The company reported ($0.15) earnings per share (EPS) for the quarter, Zacks reports. Burning Rock Biotech had a negative net margin of 26.04% and a negative return on equity of 23.61%. The business had revenue of $20.74 million during the quarter.

Burning Rock Biotech Trading Down 3.6%

Shares of BNR traded down $0.32 during mid-day trading on Friday, reaching $8.49. The company's stock had a trading volume of 24,345 shares, compared to its average volume of 51,006. Burning Rock Biotech has a 1-year low of $2.18 and a 1-year high of $11.12. The stock has a market cap of $91.37 million, a P/E ratio of -4.47 and a beta of 0.91. The business has a 50-day simple moving average of $7.03 and a two-hundred day simple moving average of $4.86.

About Burning Rock Biotech

(

Get Free Report)

Burning Rock Biotech Limited primarily develops and commercializes cancer therapy selection tests in the People's Republic of China. It operates in three segments: Central Laboratory Business, In-Hospital Business, and Pharma Research and Development Services. The company primarily offers next-generation sequencing-based tissue and liquid biopsy cancer therapy selection and prognosis prediction tests for various range of cancer types, including lung cancer, gastrointestinal cancer, prostate cancer, breast cancer, lymphomas, thyroid cancer, colorectal cancer, ovarian cancer, pancreatic cancer, and bladder cancer using tissue and liquid biopsy samples.

Featured Stories

Before you consider Burning Rock Biotech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Burning Rock Biotech wasn't on the list.

While Burning Rock Biotech currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.