C3.ai (NYSE:AI - Get Free Report)'s stock had its "hold" rating reaffirmed by equities research analysts at Needham & Company LLC in a research note issued on Monday,Benzinga reports.

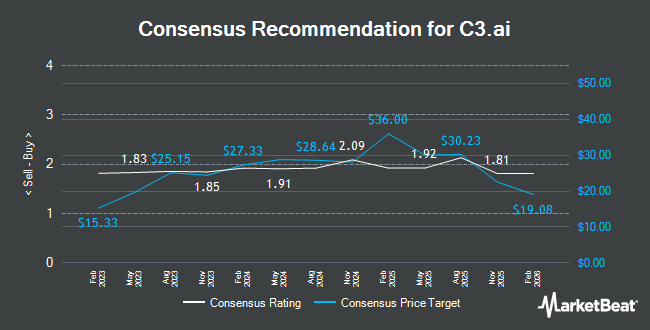

A number of other equities research analysts have also recently commented on the company. JMP Securities restated a "market outperform" rating and set a $50.00 target price on shares of C3.ai in a research report on Friday, July 25th. DA Davidson reaffirmed an "underperform" rating and set a $13.00 price objective (down from $25.00) on shares of C3.ai in a research report on Monday. KeyCorp reaffirmed a "mixed" rating on shares of C3.ai in a research report on Thursday, May 29th. JPMorgan Chase & Co. decreased their price objective on shares of C3.ai from $27.00 to $23.00 and set an "underweight" rating for the company in a research report on Thursday, May 29th. Finally, Oppenheimer reduced their price target on shares of C3.ai from $56.00 to $45.00 and set an "outperform" rating for the company in a research report on Thursday, May 29th. Five analysts have rated the stock with a sell rating, six have issued a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $29.43.

Get Our Latest Analysis on C3.ai

C3.ai Price Performance

NYSE AI opened at $22.13 on Monday. The stock's fifty day moving average price is $25.26 and its 200 day moving average price is $24.72. C3.ai has a 1 year low of $17.03 and a 1 year high of $45.08. The company has a market cap of $2.97 billion, a price-to-earnings ratio of -9.88 and a beta of 1.98.

C3.ai (NYSE:AI - Get Free Report) last announced its quarterly earnings results on Wednesday, May 28th. The company reported ($0.16) earnings per share for the quarter, topping the consensus estimate of ($0.20) by $0.04. The company had revenue of $108.72 million for the quarter, compared to the consensus estimate of $107.85 million. C3.ai had a negative return on equity of 33.51% and a negative net margin of 74.21%. The firm's revenue for the quarter was up 25.5% compared to the same quarter last year. During the same period last year, the firm earned ($0.11) EPS. Research analysts expect that C3.ai will post -2.44 earnings per share for the current year.

Insiders Place Their Bets

In other news, VP Merel Witteveen sold 5,485 shares of the firm's stock in a transaction that occurred on Monday, June 16th. The shares were sold at an average price of $23.95, for a total transaction of $131,365.75. Following the completion of the transaction, the vice president directly owned 13,740 shares of the company's stock, valued at $329,073. This trade represents a 28.53% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director John E. Hyten sold 10,000 shares of the firm's stock in a transaction that occurred on Friday, June 13th. The stock was sold at an average price of $23.75, for a total transaction of $237,500.00. Following the transaction, the director directly owned 63,942 shares of the company's stock, valued at $1,518,622.50. This represents a 13.52% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 2,298,892 shares of company stock worth $58,428,808 over the last ninety days. Company insiders own 33.54% of the company's stock.

Institutional Investors Weigh In On C3.ai

Several hedge funds have recently added to or reduced their stakes in the business. Garde Capital Inc. acquired a new position in C3.ai in the first quarter valued at about $29,000. Russell Investments Group Ltd. raised its stake in C3.ai by 100.7% during the fourth quarter. Russell Investments Group Ltd. now owns 909 shares of the company's stock worth $31,000 after acquiring an additional 456 shares in the last quarter. Orion Capital Management LLC acquired a new position in C3.ai during the fourth quarter worth about $34,000. CX Institutional acquired a new position in C3.ai during the first quarter worth about $34,000. Finally, Raiffeisen Bank International AG acquired a new position in C3.ai during the fourth quarter worth about $36,000. Institutional investors and hedge funds own 38.96% of the company's stock.

About C3.ai

(

Get Free Report)

C3.ai, Inc operates as an enterprise artificial intelligence (AI) software company in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company provides C3 AI platform, an application development and runtime environment that enables customers to design, develop, and deploy enterprise AI applications; C3 AI Ex Machina for analysis-ready data; C3 AI CRM, an industry specific customer relationship management solution; and C3 Generative AI Product Suite that enables to locate, retrieve, and present information.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider C3.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C3.ai wasn't on the list.

While C3.ai currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.