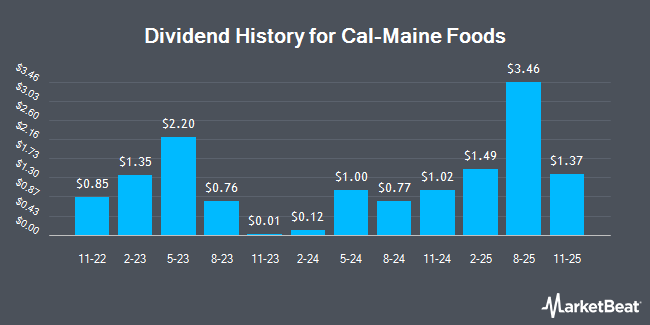

Cal-Maine Foods, Inc. (NASDAQ:CALM - Get Free Report) announced a quarterly dividend on Wednesday, October 1st. Shareholders of record on Wednesday, October 29th will be given a dividend of 1.37 per share by the basic materials company on Thursday, November 13th. This represents a c) annualized dividend and a yield of 6.0%. The ex-dividend date of this dividend is Wednesday, October 29th.

Cal-Maine Foods has a dividend payout ratio of 426.2% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Research analysts expect Cal-Maine Foods to earn $4.69 per share next year, which means the company may not be able to cover its $13.98 annual dividend with an expected future payout ratio of 298.1%.

Cal-Maine Foods Price Performance

CALM stock traded down $0.97 during midday trading on Thursday, hitting $91.99. The stock had a trading volume of 546,671 shares, compared to its average volume of 960,775. The firm has a market cap of $4.51 billion, a PE ratio of 3.69 and a beta of 0.22. Cal-Maine Foods has a 12-month low of $75.61 and a 12-month high of $126.40. The company's 50-day moving average price is $107.54 and its 200 day moving average price is $100.30.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last released its earnings results on Wednesday, October 1st. The basic materials company reported $4.12 EPS for the quarter, missing the consensus estimate of $4.55 by ($0.43). The firm had revenue of $922.60 million during the quarter, compared to analysts' expectations of $931.62 million. Cal-Maine Foods had a return on equity of 54.81% and a net margin of 28.63%.The firm's revenue was up 17.4% on a year-over-year basis. During the same period in the previous year, the firm posted $3.06 earnings per share. As a group, sell-side analysts anticipate that Cal-Maine Foods will post 15.59 EPS for the current year.

Institutional Trading of Cal-Maine Foods

Institutional investors have recently added to or reduced their stakes in the business. IFP Advisors Inc boosted its position in Cal-Maine Foods by 195.1% during the 2nd quarter. IFP Advisors Inc now owns 239 shares of the basic materials company's stock worth $25,000 after purchasing an additional 158 shares during the period. Financial Management Professionals Inc. acquired a new position in Cal-Maine Foods in the 1st quarter worth $30,000. Investment Management Corp VA ADV lifted its holdings in Cal-Maine Foods by 172.2% in the 1st quarter. Investment Management Corp VA ADV now owns 392 shares of the basic materials company's stock worth $36,000 after buying an additional 248 shares in the last quarter. Caitong International Asset Management Co. Ltd acquired a new position in Cal-Maine Foods in the 1st quarter worth $52,000. Finally, AdvisorNet Financial Inc acquired a new position in Cal-Maine Foods in the 2nd quarter worth $54,000. 84.67% of the stock is owned by hedge funds and other institutional investors.

About Cal-Maine Foods

(

Get Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.