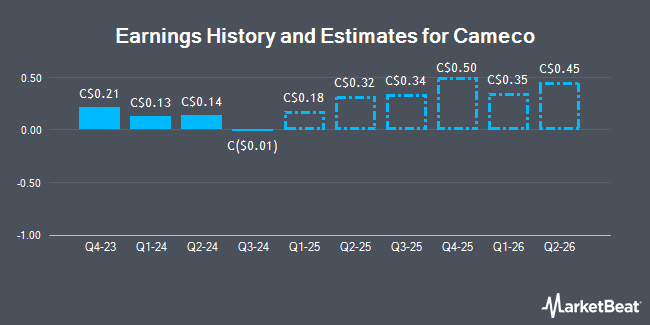

Cameco Co. (TSE:CCO - Free Report) NYSE: CCJ - National Bank Financial raised their FY2026 earnings per share estimates for shares of Cameco in a note issued to investors on Sunday, April 27th. National Bank Financial analyst M. Sidibe now forecasts that the company will earn $1.85 per share for the year, up from their previous estimate of $1.71. National Bank Financial also issued estimates for Cameco's FY2027 earnings at $1.98 EPS.

Other equities analysts also recently issued reports about the stock. National Bankshares cut their price target on shares of Cameco from C$87.00 to C$81.00 and set an "outperform" rating on the stock in a report on Wednesday, April 2nd. Raymond James cut their target price on Cameco from C$84.00 to C$83.00 and set an "outperform" rating on the stock in a research note on Friday. Sanford C. Bernstein upgraded shares of Cameco to a "strong-buy" rating in a research note on Tuesday, April 1st. Stifel Canada raised Cameco to a "strong-buy" rating in a research note on Wednesday, March 12th. Finally, Scotiabank cut their target price on shares of Cameco from C$85.00 to C$81.00 and set an "outperform" rating on the stock in a research report on Tuesday, March 25th. Seven equities research analysts have rated the stock with a buy rating and five have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of C$82.75.

View Our Latest Analysis on CCO

Cameco Trading Up 3.0 %

CCO stock traded up C$1.89 during mid-day trading on Wednesday, reaching C$64.89. 977,808 shares of the stock traded hands, compared to its average volume of 1,196,328. Cameco has a one year low of C$48.71 and a one year high of C$88.18. The stock has a market capitalization of C$28.56 billion, a PE ratio of 245.17, a PEG ratio of 2.22 and a beta of 0.90. The company has a debt-to-equity ratio of 20.35, a quick ratio of 3.74 and a current ratio of 2.88. The business has a 50-day moving average price of C$59.71 and a two-hundred day moving average price of C$69.70.

Cameco Company Profile

(

Get Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Featured Articles

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.