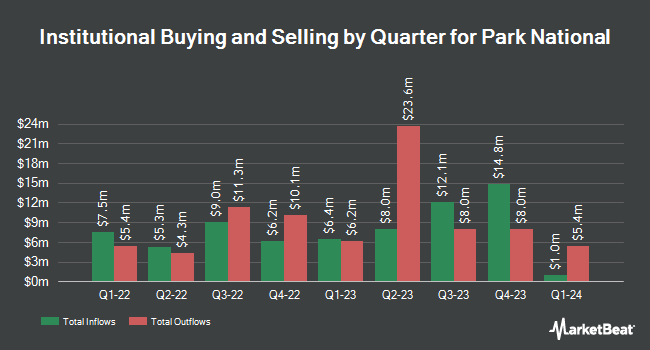

Canada Pension Plan Investment Board acquired a new position in Park National Co. (NYSE:PRK - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 5,900 shares of the company's stock, valued at approximately $1,011,000.

Several other institutional investors and hedge funds also recently made changes to their positions in the stock. Vanguard Group Inc. lifted its position in shares of Park National by 0.4% during the 4th quarter. Vanguard Group Inc. now owns 1,701,587 shares of the company's stock worth $291,703,000 after buying an additional 6,432 shares during the period. Invesco Ltd. lifted its stake in shares of Park National by 22.8% during the fourth quarter. Invesco Ltd. now owns 107,428 shares of the company's stock valued at $18,416,000 after acquiring an additional 19,948 shares during the period. Principal Financial Group Inc. boosted its stake in shares of Park National by 2.9% in the 4th quarter. Principal Financial Group Inc. now owns 70,523 shares of the company's stock valued at $12,090,000 after purchasing an additional 2,007 shares during the last quarter. JPMorgan Chase & Co. boosted its stake in Park National by 427.9% in the fourth quarter. JPMorgan Chase & Co. now owns 64,482 shares of the company's stock valued at $11,054,000 after acquiring an additional 52,268 shares during the last quarter. Finally, American Century Companies Inc. grew its stake in shares of Park National by 10.7% during the fourth quarter. American Century Companies Inc. now owns 37,027 shares of the company's stock worth $6,348,000 after purchasing an additional 3,564 shares during the period. Institutional investors own 62.65% of the company's stock.

Analysts Set New Price Targets

Several brokerages have commented on PRK. Piper Sandler started coverage on shares of Park National in a research note on Thursday, February 20th. They issued a "neutral" rating and a $185.50 target price for the company. Keefe, Bruyette & Woods raised their price target on shares of Park National from $167.00 to $170.00 and gave the stock a "market perform" rating in a research note on Wednesday.

Read Our Latest Report on Park National

Park National Stock Performance

PRK stock traded down $1.45 during trading hours on Wednesday, reaching $150.10. The stock had a trading volume of 100,947 shares, compared to its average volume of 56,846. Park National Co. has a fifty-two week low of $131.93 and a fifty-two week high of $207.99. The company has a debt-to-equity ratio of 0.15, a current ratio of 0.94 and a quick ratio of 0.95. The stock has a market capitalization of $2.43 billion, a PE ratio of 16.12 and a beta of 0.72. The stock has a 50-day simple moving average of $152.00 and a 200 day simple moving average of $168.92.

Park National Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, June 10th. Stockholders of record on Friday, May 16th will be paid a dividend of $1.07 per share. The ex-dividend date of this dividend is Friday, May 16th. This represents a $4.28 annualized dividend and a dividend yield of 2.85%. Park National's dividend payout ratio is currently 45.97%.

About Park National

(

Free Report)

Park National Corporation operates as the bank holding company for Park National Bank that provides commercial banking and trust services in small and medium population areas. The company offers deposits for demand, savings, and time accounts; trust and wealth management services; cash management services; safe deposit operations; electronic funds transfers; Internet and mobile banking solutions with bill pay service; credit cards; and various additional banking-related services.

Further Reading

Before you consider Park National, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Park National wasn't on the list.

While Park National currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.