Canadian Imperial Bank of Commerce (NYSE:CM - Get Free Report) TSE: CM was upgraded by Wall Street Zen from a "sell" rating to a "hold" rating in a report issued on Saturday.

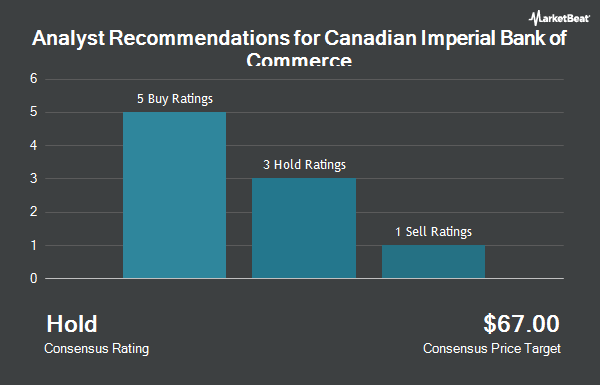

Several other equities research analysts have also recently issued reports on CM. Scotiabank assumed coverage on shares of Canadian Imperial Bank of Commerce in a report on Thursday, May 15th. They issued a "sector outperform" rating on the stock. National Bank Financial downgraded shares of Canadian Imperial Bank of Commerce from an "outperform" rating to a "sector perform" rating in a report on Friday, May 30th. Jefferies Financial Group downgraded shares of Canadian Imperial Bank of Commerce from a "buy" rating to a "hold" rating in a report on Monday, April 21st. Royal Bank Of Canada boosted their price objective on shares of Canadian Imperial Bank of Commerce from $108.00 to $116.00 and gave the company an "outperform" rating in a research report on Friday, May 30th. Finally, BMO Capital Markets boosted their price objective on shares of Canadian Imperial Bank of Commerce from $98.00 to $102.00 and gave the company an "outperform" rating in a research report on Friday, May 30th. Three investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, Canadian Imperial Bank of Commerce has a consensus rating of "Moderate Buy" and a consensus target price of $109.00.

Read Our Latest Research Report on CM

Canadian Imperial Bank of Commerce Stock Up 0.9%

Shares of NYSE CM traded up $0.68 on Friday, reaching $72.64. 1,121,051 shares of the company's stock traded hands, compared to its average volume of 1,342,344. Canadian Imperial Bank of Commerce has a 12 month low of $50.49 and a 12 month high of $74.63. The business's 50 day simple moving average is $71.06 and its two-hundred day simple moving average is $64.39. The company has a market cap of $67.67 billion, a price-to-earnings ratio of 12.77, a price-to-earnings-growth ratio of 1.58 and a beta of 1.06. The company has a quick ratio of 1.05, a current ratio of 1.05 and a debt-to-equity ratio of 0.16.

Canadian Imperial Bank of Commerce (NYSE:CM - Get Free Report) TSE: CM last announced its earnings results on Thursday, May 29th. The bank reported $1.44 earnings per share for the quarter, beating analysts' consensus estimates of $1.34 by $0.10. The business had revenue of $5.09 billion during the quarter, compared to the consensus estimate of $4.78 billion. Canadian Imperial Bank of Commerce had a net margin of 12.19% and a return on equity of 14.51%. The business's revenue for the quarter was up 13.9% on a year-over-year basis. During the same quarter last year, the firm earned $1.75 earnings per share. As a group, equities research analysts forecast that Canadian Imperial Bank of Commerce will post 5.5 EPS for the current fiscal year.

Institutional Trading of Canadian Imperial Bank of Commerce

Institutional investors have recently modified their holdings of the stock. Ontario Teachers Pension Plan Board purchased a new position in Canadian Imperial Bank of Commerce during the second quarter worth about $3,271,000. Cetera Investment Advisers increased its stake in Canadian Imperial Bank of Commerce by 1.0% during the 2nd quarter. Cetera Investment Advisers now owns 27,792 shares of the bank's stock worth $1,969,000 after buying an additional 268 shares during the period. Creative Planning grew its holdings in Canadian Imperial Bank of Commerce by 19.0% during the 2nd quarter. Creative Planning now owns 80,695 shares of the bank's stock worth $5,716,000 after acquiring an additional 12,896 shares in the last quarter. Cherokee Insurance Co purchased a new stake in shares of Canadian Imperial Bank of Commerce during the 2nd quarter worth approximately $1,308,000. Finally, Geode Capital Management LLC lifted its position in shares of Canadian Imperial Bank of Commerce by 19.7% during the 2nd quarter. Geode Capital Management LLC now owns 7,547,548 shares of the bank's stock worth $542,697,000 after buying an additional 1,244,271 shares during the last quarter. Institutional investors and hedge funds own 49.88% of the company's stock.

Canadian Imperial Bank of Commerce Company Profile

(

Get Free Report)

Canadian Imperial Bank of Commerce, a diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally. The company operates through Canadian Personal and Business Banking; Canadian Commercial Banking and Wealth Management; U.S.

Featured Stories

Before you consider Canadian Imperial Bank of Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Imperial Bank of Commerce wasn't on the list.

While Canadian Imperial Bank of Commerce currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.